KEY TAKEAWAYS - India’s merchandise trade deficit widened to a monthly record high of USD 24.3 bn in May-22 from USD 20.1 bn in Apr-22.

- The expansion of the trade deficit was driven by a modest sequential contraction in exports, in contrast to imports that saw a sharp pick-up.

- It is comforting to note that the share of petroleum trade deficit in total trade deficit moderated to a 6-month low of 43.8% in May-22 (on likelihood of increased supplies of Russian oil) vis-à-vis an average of 56.0% between Feb-Apr-22.

- Nevertheless, concerns persist on account of expectation of deceleration in global trade activity, persistence of elevated commodity and particularly crude oil prices, and protectionist overtures by many countries.

- Overall, we now see buildup of significant risk to our FY23 current account deficit forecast of USD 90 bn.

|

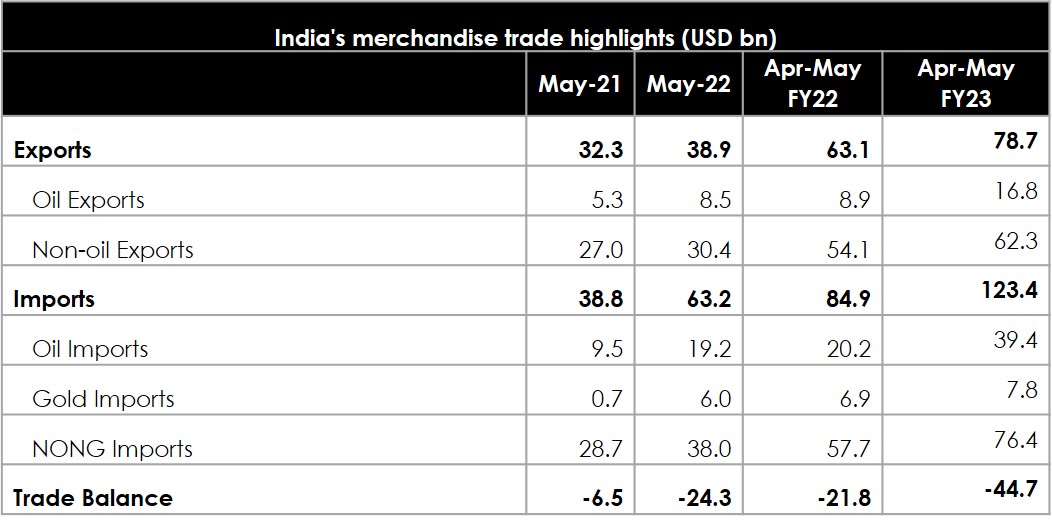

India’s merchandise trade deficit scaled a record high of USD 24.3 bn in May-22 vis-à-vis USD 20.1 bn in Apr-22. The expansion of trade deficit was driven by a sequential contraction in exports, in contrast to imports that saw a pick-up. While normalization of the trade deficit had started with the declining intensity of the pandemic, it accelerated significantly with the spurt in crude oil prices from second half of FY22. On a YoY basis, the trade deficit in May-22 was 6.7 times and 3.7 times of the deficit in May-21 and May-20 respectively.

Exports

In value terms, merchandise exports moderated to USD 38.9 bn in May-22 from USD 39.8 bn in Apr-22. This translates into a sequential contraction of 2.1% MoM.

- The sequential decline was led by exports of Ores & Minerals (USD -0.3 bn), Electronics (USD -0.3 bn), and Textiles (USD -0.3 bn).

- Meanwhile export of Petroleum Products touched a new monthly record of USD 8.5 bn. This is the second month in succession when petroleum exports have created a new high and is reflective of the impact from continued hardening of crude oil prices since the beginning of Russia-Ukraine crisis (monthly average price of Brent moved from USD 94 pb in Feb-22 to USD 121 pb in Jun-22 so far).

Cumulative exports for the first two months of FY23 stand at USD 78.7 bn, an expansion of 24.9% compared to the corresponding period in FY22.

Imports

Merchandise imports touched a record high level of USD 63.2 bn in May-22 vis-à-vis USD 60.2 bn in Apr-22, translating into a sequential expansion of 5.0% MoM. At a granular level:

- Bulk of the sequential increase was driven by imports of Gems & Jewellery (USD 4.8 bn) and Ores & Minerals (USD 0.6 bn).

- Three categories, viz., Plastic & Rubber Articles, Wood & Wood Products, and Coal (amidst low level of domestic stocks) touched a monthly high in terms of their import bill value. In addition, gold imports jumped to 9-month high of USD 6.0 bn probably reflecting a pent-up demand after two months of subdued performance.

- Meanwhile, import of Electronic Items and Petroleum Products registered a sequential dip of USD 1.0 bn respectively.

- NONG (Non-oil-non-gold) imports, a key indicator of domestic demand, moderated slightly to USD 38.0 bn in May-22 from USD 38.4 bn in Apr-22.

Cumulative imports for the first two months of FY23 stand at USD 123.4 bn, marking an expansion of 45.4% compared to the corresponding period in FY22.

Outlook

The May-22 trade print offers both respite and anxiety. It is comforting to note that the share of petroleum trade deficit in total trade deficit moderated to a 6-month low of 43.8% in May-22 vis-à-vis an average of 56.0% between Feb-Apr-22. This has happened despite oil prices rising significantly since the start of Russia-Ukraine crisis even as import volumes are likely to have held up (up ~18% between Apr-Feb-22). We note that while petroleum exports have increased by 84% between Feb-22 and May-22, petroleum imports have risen by just 26% in the same period. The relatively tepid increase in petroleum imports point towards the likelihood of increased supplies from Russia (as per media reports, Russia accounted for 18% of India’s crude imports in May-22, a significant rise from 1% before the escalation of the crisis with Ukraine). A persistence of this trend could partially moderate the impact of elevated crude oil prices on India’s FY23 current account deficit.

Having said so, there are also some areas of concern:

- The geopolitical crisis continues unfettered for the fourth consecutive month, keeping global commodity prices elevated. The ongoing conflict would dampen world trade volume (recently the WTO scaled down its projection for merchandise trade volume growth for 2022 to 3.0% from 4.7% projected earlier).

- International commodity prices continue to remain elevated due to heightened geopolitical uncertainty and persistent supply disruptions in few commodities (in last four months, considerable increase is seen in case of price of Natural Gas, Coal, food items like sunflower oil, tea, wheat, soybean oil, Nickel, etc.). On monthly average basis, the generic Reuters CRB Commodity Index is up by 43% in 2022 so far.

- Unlocking of the domestic economy post the Omicron wave along with vaccination drive gaining critical mass (with 65% of the population having received double dose) is expected to support domestic demand for imports.

- In the very near term, a marginal adverse impact on exports can come from the recently imposed export restrictions by the government in case of select commodities.

Overall, we now see buildup of significant risk to our FY23 current account deficit forecast of USD 90 bn.

Table 1: Highlights of merchandise trade balance

Note: Numbers may not add up due to rounding off and revision in headline exports and imports

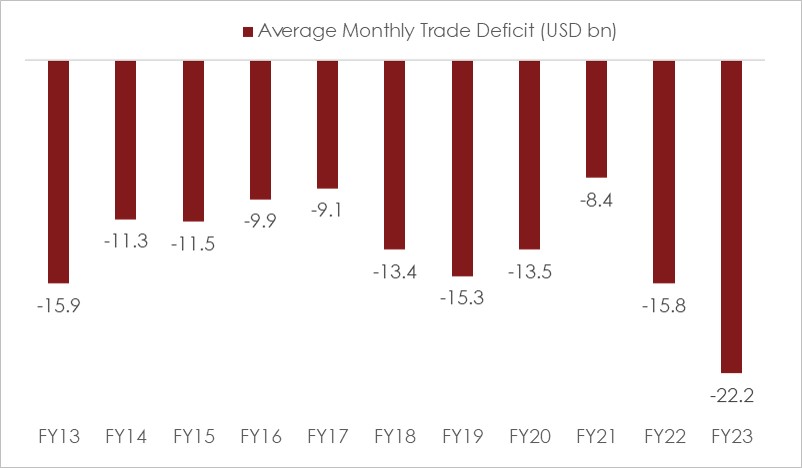

Chart 1: Average monthly trade deficit has jumped 40% in FY23* so far from FY22

* Only 2 months for FY23