24 Jan 2019

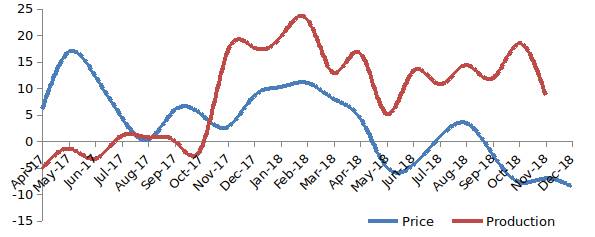

Cement production has been exhibiting a strong growth since November, 2017 and expanding at a pace of around 14%. This strong growth in production has led to a supply glut in the system. However, despite this growth, capacity utilization hasn’t peaked out yet. We see this as a repercussion of the growth phase (2003-07), when massive capacities were created in anticipation of demand, which in turn never provided the intended returns. Therefore, sectors such as cement continue to languish with lower than potential output. Further consolidations in the sector may alleviate this problem as that may lead to capacity rationalizations.

Due to these conditions, cement prices have been declining over the past four months. Demand nevertheless remained strong and it showed on cement company financials. The YoY growth (Quarter wise) in sales has been a very healthy 18.9% in Q3 FY19 as compared to 13.5% recorded in Q2. EBITDA margins also improved substantially by recording a growth of 16.4% as compared to contractions over the previous two quarters. We see this as a result of lowering input cost pressures on the back of declining commodity prices such as coal and oil.

Pertaining to the end users, inventory of housing has marginally declined to 4.68 lakh units in 2018 from 5.2 lakhs units in 2017. The sales to launch ratio has however declined to 1.33 in 2018 after an improvement in 2017, which is a sign of slower sales but higher inventory added in the system.

YoY change in Production and Price of Cement:

Source: Acuité Research, CMIE

Source: Acuité Research, CMIE

In lakh Units | Launches | Sales | Sales/Launches Ratio |

2013 | 4.2 | 3.3 | 0.79 |

2014 | 3.2 | 2.8 | 0.88 |

2015 | 2.4 | 2.6 | 1.08 |

2016 | 1.7 | 2.4 | 1.41 |

2017 | 1.03 | 2.28 | 2.21 |

2018 | 1.82 | 2.42 | 1.33 |

Source: Acuité Research, Kinght Frank