03 Aug 2018

Impact: Positive (Overall Manufacturing), Positive (Petroleum Refineries), Positive (Steel), Positive (Cement), Positive (Electricity), Negative (Fertilizer)

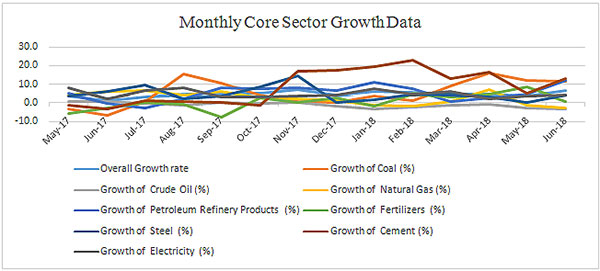

Brief: June Core Industry recorded an expansion of 6.7% on a lower base of the previous year; Coal and Fertilizer expand on similar lines; Electricity and Steel however maintain momentum despite an unfavorable base effect

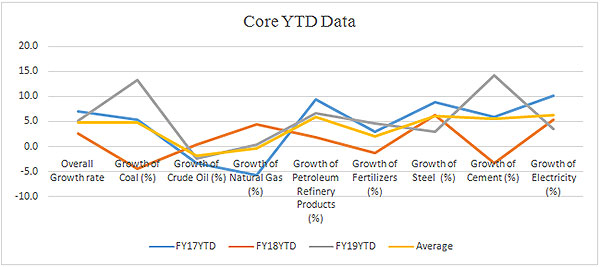

The YTD data for most Core categories presents a strong case of base effect bias (both positive and negative). While FY18 was negatively influenced by strong show in FY17 YTD numbers, FY19 gained from the low base. Therefore, even though overall Core industry data correlates well with the IIP narrative, there is a certain lack of clarity as there seems to be a seasonality.

Despite this however, sectors such as Steel, Electricity and Petroleum Refinery are clear outliers and have been performing well consistently. On a YTD basis, the three sectors recorded 6%, 6.3% and 5.9% respectively on average (three-year data). On a monthly basis Steel expanded by 4.4%, Petroleum Refinery expanded by 12% and Electricityby 4% in June despite an unfavorable base. In the same way, the solid performance recorded by Coal can therefore be attributed to a favorable base effect. Cement sector, which is understood to be a consistent performer can also be clubbed with Coal as it benefits from the contraction same time last year. However, despite these statistical linkages, both Coal and Cement sectors have been expanding capacity and recording a solid double digit growth in the current financial year. Fertilizer category continues its below average performance due to low capacity utilization levels and low demand after the enactment of the neem coated urea regulations.

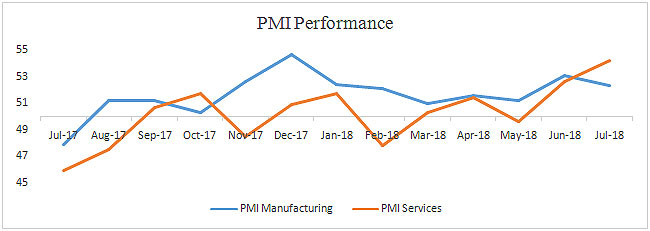

As far as the PMI data is concerned, both the manufacturing and service segments have remained over 50, signifying strong expansionary phase. In July, PMI Manufacturing was recorded at 52.3, with a base of around 48. We believe that PMI and IIP (including Core Industries) operate in a two-month lag environment. What this means is that the sentiment of the purchase manager is reflected by industrial production after two months. We are therefore of the view that the IIP (including Core) will continue its solid performance even though the apparent seasonality is at play here. From the Service sector point of view, there has been encouraging news as well given the Service PMI recording a 54.2 print on a base of around 46. Again, a favorable base at play but inter sectoral linkages cannot be ruled out.