10 Sep 2018

Impact: Neutral (Public Finances)

Brief: As per the annual Public Debt Management report, the Government of India has drastically increased issuances in the less than 5 years' maturity bucket - a three year high. The strategy of front loading of issuances was brought forward but results in a risk emanating from negative carry

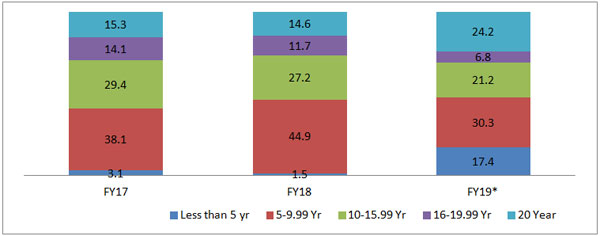

According to the Public Debt Management report, published annually by the RBI, there have been some developments of note. On the face of it, even though the number of issuances and re-issuances remained near the norm, the strategy was very different. Given the risk of rising interest rates amidst global volatility and a hawkish US Fed, market actors (including the Government) have been playing in shorter duration maturity buckets. This is seen as a strategy to limit exposure to mark to market risks, which in turn is connected to the duration risk in a high interest rate environment. As a result, the report states that the share of debt issued in FY18 of duration less than 10 years – increased to 46.4% as compared to the previous year's 41.2%. What's even more interesting is the fact that in YTD FY19, the share of debt issued of duration less than 5 years – increased to 17.4% as compared to the previous year's (annual share) 1.5%. In terms of overall weighted average maturity (WAM) for Government debt, the maturity declined slightly to 14.13 years in FY18 as compared to the previous year's 14.76 years. This reflects the new issuance strategy as part of public debt management as even the states have substantially increased their investment in 14 day auctions of central Government securities (money market) – a new found phenomenon.

The benefits are not far behind as average yields for Government of India (Central) dated securities reduced by almost 17 bps in FY18 – settling at 6.97% (previous, 7.16%). Following, cost of borrowing has come down by 23 bps in the last financial year. Hedging and diversifying of the Government's exposure resulted in the issuance of Sovereign Gold Bonds (SGBs) in fourteen tranches. However, in cognizance to rising hegemony of the American Dollar and lower than usual investor demand for Gold resulted in the total value of the issued SGBs being Rs. 18.95 billion (6.52 tons) as compared to FY17's issuance of Rs. 34.69 billion (11.44 tons). We believe that a lack of success in diversifying the exposure (through Gold) is inline with the broader macro risk to security pricing, which is no longer a local event.

The primary concern however remains the rising issuances of State Development Loans (SDLs), which is crowding out the market and thereby jacking up yields. Over the past two financial years, SDL yields have risen by nearly 20 bps despite several interest rate cuts in the previous financial. The yield differential between an auctioned SDL and a similarly dated Central Government security is expected to only rise in the current financial, given the dual threat of continued higher issuances and rising interest rates. As mentioned, it is part of the state Governments' strategy (like the Central Government) to front load issuances to guarantee committed expenditure (Planned). This makes sense given the rising Ways and Means Advances (WMA) days as well as rising usage of Overdraft/ WMA facilities not only among states but the center as well. However, due to lack capacity to invest/ deploy this money raised from the market is resulting in a negative carry risk worth nearly Rs. 2,500 billion for the states alone.

Percentage distribution of Government debt based on maturity

Source: RBI

Source: RBI