11 Dec 2018

Impact: Positive (Service and Manufacturing), Positive (Consumer Sentiment)

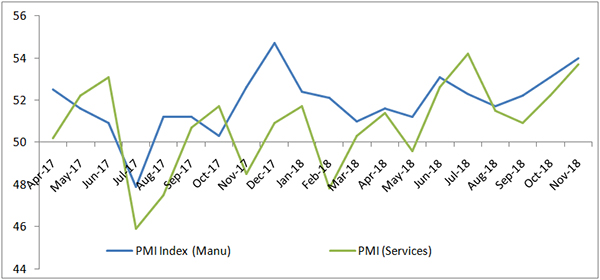

Brief: Manufacturing PMI index stands at a nine month high of 54. Similarly, services index stands at a four month high of 53.7. One reason is the sharp contraction in crude oil and coal prices along with some basic metals since November, 2018. Therefore, firms that were facing higher input cost pressure are likely to get relief soon.

After almost two years, PMI index for both manufacturing and service post a robust number. While the manufacturing PMI index stands at a nine month high of 54, the service counterpart stands at 53.7, a four month high. The trends give a sense that firms in both services and manufacturing sectors are optimistic about the future outlook and therefore anticipate robust business growth. Higher print in PMI index is quite relevant here as Q2 GDP print shows softening consumer demand. Private consumption has expanded by a comparatively lower 7% in Q2, a development which gives a negative sentiment to the market.

Looking at these developments, we reckon that the fall in commodity prices and strengthening Indian rupee against the USD may revive private consumption, going forward. There is a sharp contraction in crude oil and coal prices along with some basic metals since November, 2018 and therefore, firms that were facing higher input cost pressures are likely to get relief, over the coming months. The higher PMI index number is therefore indicating that firms are already assuming a downward trend in input costs and taking business decisions accordingly. As the negative factors wane out, business sentiment is likely to regain further momentum - a development which we believe, will be reflected in the IIP numbers as well.

PMI Index (Service & Manufacturing):

Source: IHS Markit, Acuité Research

Source: IHS Markit, Acuité Research