02 Nov 2018

Impact Positive (Manufacturing sector, Transport Sector)

Brief: The PMI number remains on a roll for a second consecutive month in October, 2018 as it stands at 53.1. The October print gives a sense that firms are optimistic about the future outlook of the industry. Weaker value of Indian rupee is acting as an edge for exporters in terms of competitiveness. Therefore, domestic firms are receiving higher orders from abroad. Firms are piling up input inventories as they are expecting the strong demand to continue in the months to come.

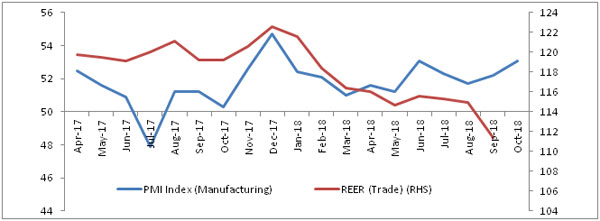

The PMI number remains on the roll for a second consecutive month in October, 2018 as it stands at 53.1. The October print gives sense that firms are optimistic about the future outlook of the industry. Solid growth in new orders, which is a result of strong demand is the primary source of confidence for the sector. Along with strong domestic demand, the sector is also receiving orders from the external market as well. This indicates that India's manufacturing exports are expected to continue their momentum in coming months as well.

Moreover, positive global economic outlook will be a tailwind for this sector. Another factor that is boosting Indian manufacturers' confidence is the falling in value of Indian rupee as against its trading partners (both peers & non-peers). Weaker value of Indian rupee is giving an edge to the exporters in terms of competitiveness. Therefore, domestic firms are receiving a higher quantum of orders from abroad

Also, the Markit's survey reveals that while stock of finished goods has been declining, that of raw material inventories is rising. This is well corroborated with the recent industry survey of RBI. As per the RBI's assessment, finished goods inventory to sales ratio has been declining, whereas raw materials inventory to sales ratio is on an upward trend. We believe that strong demand accompanied by efficiency in supply chain/improvement in infrastructure has fastened the dispatch of products. At the same time, firms are piling up input inventories as they are expecting the strong demand to continue in months to come.

Source: Acuité Research, RBI, HIS Markit

Note: Fall in REER value indicates weakness of domestic currency; hence export will be cheaper and import will be expensive.