12 Oct 2018

Impact: Positive (Exchange Rate); Positive (Liquidity)

Brief: As on Q1 FY19, the non-resident deposits stood at $3.5 billion, three times higher ($1.2 billion) than same time, the previous year. Overall, as on FY19 YTD, the deposits have reached a three-year high of $5.7 billion, as compared to just $0.5 billion, same time last year. We reckon that these deposits will breach the $20 billion barrier by the end of this financial year given strong growth in major source nations such as those in the Middle East.

As on Q1 FY19, the non-resident deposits stood at $3.5 billion, three times higher ($1.2 billion) than same time, the previous year. Overall, as on FY19 YTD, the deposits have reached a three-year high of $5.7 billion, as compared to just $0.5 billion, same time last year. The contribution of these special accounts in India's overall Current Account Deficit (CAD) were therefore pegged at 34.4% as compared to 3.6% in FY18 YTD.

Timing for such deposits is everything and we believe that the rising oil prices are shoring up these special accounts. This is because, at 65%, oil price and NRI deposits are highly correlated and therefore, whenever oil prices go up, a strong push factor is created toward higher return avenues. Offering nearly 4.10% return for a duration that ranges between 24 to 60 months, Foreign Currency Non-Resident (Bank) deposits (FCNR (B)) are especially very popular among non-resident Indians looking to park their money in their home country. The diaspora from OPEC countries are a special mention here as their disposable income increases whenever the commodity price rises – ultimately available for such deposits through remittances.

RBI offers this service through various banks and associated dealers in order to offset the pressures created in the domestic market by FPI outflows. While NRI deposits comprises of three categories namely the FCNR (B), Non-Resident Ordinary Deposits (NRO), Non Resident External Rupee (NRER), the current circumstances make the first route most attractive from the RBI's perspective. This is because apart from FCNR (B) route, the other two are Rupee deposits, which in turn do not help the exchange rate volatility in a comprehensive manner. Curbing the falling value of Indian rupee against USD and liquidity deficit in the domestic banking system is thus an important function of these deposits. We reckon that these deposits will breach the $20 billion barrier by the end of this financial year given strong growth in major source nations such as those in the Middle East.

Capital Inflows (in $ Million)

| Capital Account * | NRI | Share in CAD | |

| FY12 | 80,612 | 11,921 | 14.8% |

| FY13 | 85,155 | 14,844 | 17.4% |

| FY14 | 33,240 | 38,406 | 115.5% |

| FY15 | 27,810 | 14,057 | 50.5% |

| FY16 | 23,161 | 16,052 | 69.3% |

| FY17 | 14,830 | -12,367 | -83.4% |

| FY18 | 47,759 | 9,676 | 20.3% |

| FY18 YTD | 15,516 | 556 | 3.6% |

| FY19 YTD | 16,561 | 5,701 | 34.4% |

Source: RBI, Acuité Research

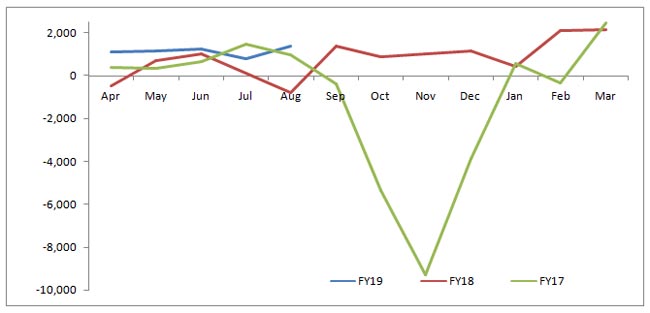

Comparative Monthly Trend in NRI Inflows

Source: RBI, Acuité Research