26 Jul 2018

Impact: Negative (Core Inflation) Negative (Fiscal Deficit), Positive (Capacity Utilization Levels)

Brief: The GST council has reduced taxes on several consumer discretionary items. This may increase consumption but add to the already worsening core inflation. Capacity utilization levels for associated industries may however be positively impacted.

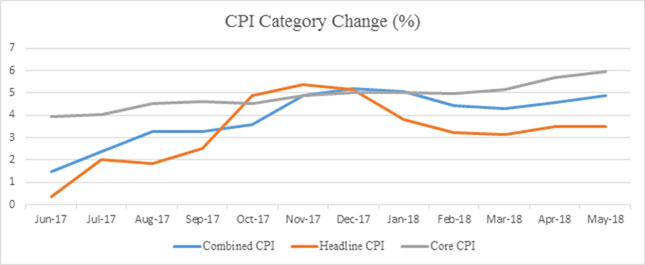

We believe that the reduction of tax rates of consumer discretionary items will stoke inflation fears over the short to medium term. Core inflation, which has seen significant convergence from Headline inflation since January 2018 has been steadily approaching the 6% target range. As of June 2018, the differential is recorded at near 250 bps. We believe that this is primarily driven by revised MSP and the implementation of the 7th Pay Commission. The lower tax structure will add to the consumption bandwagon with rural markets seeing a faster acceleration in inflation. The situation may expedite the rate hike cycle of the RBI, with a 25 bps hike coming as soon as August this year.

The estimated revenue loss for the Government will be Rs. 14,800 crores per year, which will increase Fiscal Deficit by 12 bps. This may lead to lower revenue expenditure in the short term or utilization of deficit financing or incremental cess. Given the election year, public sending may continue unabated.

We see positive impact on the Capacity Utilization levels of most manufacturing based industries and believe that this may lead to a renewal of the much needed capex cycle. Unsold inventories may also be exhausted with revised pricing. The CU is currently below the 75% level for most industries and the move will bring in the much needed respite. Backward integrated MSMEs engaged in electronics manufacturing, chemicals and handicraft will be positively impacted.

YTD Trade Performance

| Category | Previous GST | Revised GST |

| Electric Appliances | 28% | 18% |

| Vacuum Cleaners | 28% | 18% |

| Washing Machine | 28% | 18% |

| Refrigerator | 28% | 18% |

| Paint & Varnish | 28% | 18% |

| Fuel cell vehicle | 28% | 18% |

| Marble, Wood Deities | 18% | 0% |

| Rakhi | 5% | 0% |

| Sanitary Napkins | 12% | 0% |

| Jhadoo, Khali, dona | 18% | 0% |

| Phosphoric acid | 12% | 5% |

| Handloom dari, handmade carpets, lace | 12% | 5% |

| Handbags | 12% | 5% |

| Art ware of iron, brass, copper | 12% | 5% |

| Worked vegetable or mineral carving | 12% | 5% |

| Bamboo flooring | 18% | 12% |

| Hand operated rubber roller | 18% | 12% |

| Zip and Slide Fasteners | 18% | 12% |

| Ethanol | 18% | 5% |

| Solid bio fuel | 18% | 5% |

| Lithium Ion Batteries | 28% | 18% |

Source: Ministry of Finance

Source: MOSPI; Acuité Knowledge Center