10 Aug 2017

Brief: World Economic Outlook

Impact: Positive

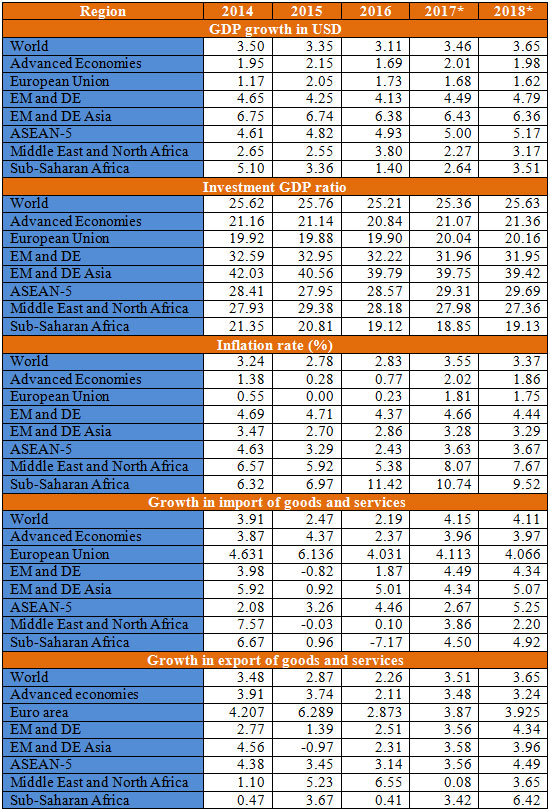

Growth outlook of the global economy has been resilient in 2017. As per IMF estimation the global economy is expected to expand by 3.46 and 3.65% in 2017 and 2018 respectively, better than the 3.1% recorded in 2016. The improvement in the global growth rate is on account of a strong recovery in the advanced economies (AEs) and stability in emerging markets (EMs). Poor performance of the advance economies in 2016 had disturbed the supply chain and thereby a lower global growth momentum was recorded. These economies, which accounts for 21% in world economy, are expected to grow at a pace of 2% in 2017 as well as 2018. Reeling under mild demand in 2016, the AEs have posted strong demand in 2017; average inflation rate too in these economies has improved to 2.0% in 2017 from 0.8% in 2016 and the trend is likely to remain at these levels in 2018. The inflation rate is expected to remain within the targeted range of the respective Central Banks of the advance economics due demand resilience. SMERA therefore expects stability in the monetary policy in the foreseeable future and this can be source for more stability in global financial markets.

Similarly, investment to GDP ratio in this region (US, EU, Japan, Australia and Canada) is expected to improve from 20.8 in 2016 to 21.36 in 2018. The ratio for global economy is expected to improve to 25.6% in 2018 from 20.8% in 2016. We consider this as a positive sign for capacity expansion, which will in turn lead to rising commodities’ price. However, investment in the Middle East and African countries has remained low owing to a lower commodity price and geo-political instability. It must be noted that most of the region (MENA and Sub Saharan Africa) is an exporter of basic commodities, which are dependent on intermediate demand as well as general demand globally.

Overall trade performance across the category is expected to remain healthy. World import volume is also growing at 4.1% in 2017 and same pace is expected in 2018 as well. Import growth has decelerated to 2.2% in 2016 given rising protectionism and import substitution. However, inward looking policy of the advance economies would disturb the supply chain.

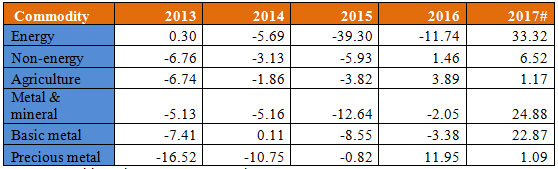

With the healthy demand the commodity prices (except agro commodities and precious metal) are galloping at double digit rate in 2017. SMERA believes that upward trend in commodity price will benefit the India’s domestic basic goods industries. However, this will attribute to a higher inflation rate. Positive growth outlook in the global economy shows India’s external demand is expected to be robust. At the same time, domestic demand backed by massive government expenditure and healthy monsoon will act as an additional buffer.

Region wise performance (macro variables):

Source: IMF, SMERA Research

Note: "*” indicates IMF estimates;

DE - Developing Economies; ASEAN – Association of Southeast Asian Nation

Global commodity price movement (% change YoY):

Source: World Bank, SMERA Research

Note: "#” indicates average price change till July;

Energy includes price of crude oil, coal and natural gas

Non-energy includes price of metals, agricultural commodities and fertilizer