12 Dec 2017

SMERA Commentary on Fifth bi-monthly MPC meet:

The MPC has kept the repo rate unchanged at 6%, in line with SMERA expectations. The MPC maintained status quo primarily because of lowering yield spreads and declining liquidity.

Global economic condition:

While the rising correlation among global trading partners has been a major factor influencing India’s monetary policy the question of international capital flight persists. The RBI has taken a special note of the international scene and increasingly factors in the developments while formulating monetary policy. Since the financial crises in 2008, through two phases ofquantitative easing (Q1 and Q2), over $12 trillion has been added to the global liquidity. The resultant cheap money has been floating across the world in search of higher yields shoring up equity and debt markets. Lately, India is one of the major recipients of these outflows and recent rallies mounted on FPI and FDI equity confirms this belief system. Volatilities emanating from the normalizing trends in the US in terms of reverting to the mean interest rates as well as solid jobs numbers make things shaky in the emerging market landscape, especially India. We believe that one of the important reasons for the MPC to show restraint was the narrowing yields between Indian and US 10 Y GSecs. The differential is fast approaching the 450 bps threshold (nominal) and further rate cuts will make Indian asset classes less attractive and may negatively impact Indian debt, especially fresh issuances. The market on the other hand continues to expect the interest rates to go up in the prevailing conditions. This is probably not the right time to cut rates when the fiscal side will make its rightward movement; not to forget the recapitalization of banks, which may have to raise some of their own debt in the open market.

On the positive side though, uptick in economic activities in the advanced economies, especially the US and stabilizing EU has been a positive indicator. The RBI notes theunemployment rate in the US, which dropped to an all-time low 4.1% in November, 2017. Similarly, Europe and Japan recorded their respective numbers at 8.6% and 2.8%.These figures also carry the statusof spawningthe lowest unemployment rate in the last 10 years. Lower unemployment rate hints robust growth in private consumption inthese nations in the near term and their imports may be positively impacted.India’s trade, especially basic and intermediate as well as ITES, Financial Services is expected to benefit from this trend. Even though, Gems and Jewelry sector is another sector that is highly correlated to this development - a high interest regime generally nullifies any benefits for the sector.As India’s economy moves up the value chain, we see certain benefits for consumer durables, non-durables and heavy engineering goods but these categories remain subdued given heightened competition from other Asian nations such as Vietnam and continuously by China. Therefore margin pressures remain high.

However, along with this lower than expected growth in exports as reported by the WTO, RBI is more concerned about rise in crude prices. As OPEC and Russia have agreed to cut oil production by 1.8 million barrel per day till 2018,the rise in oil demand is expected to keep crude oil price high. SMERA expects crude oil price to hover in the range of $60-$65 a barrel during H2, FY18. It is worth mentioning though that if global trade volume is concerned,global export growth is expected to accelerate in 2018. In 2017, the advanced economies’ trade policy was more restrictive as those nations were recovering from a slowdown and higher unemployment rate. With a rebound in GDP growth and employment rate however, trade is expected to gain momentum. The RBI is cautious regarding this development and awaits more data.

Inflationary and Liquidity conditions:

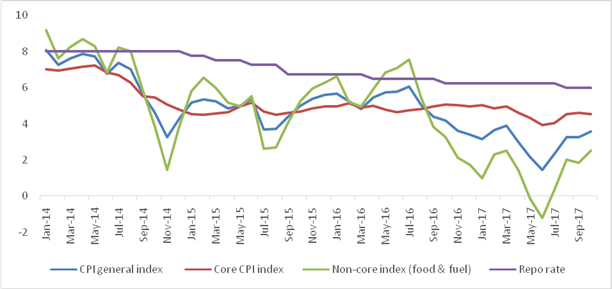

Consumer inflation increased by 200 bps in past four months and reached 3.6% in October, 2017. The faster acceleration in inflation rate is due to rebound in food and fuel prices. It needs to be noted that RBI set the target for CPI inflation rate at 4%. We feel that the non-core inflation is likely to exceed RBI’s target level in January 2018. However, this will start to decelerate from Q1, FY19 onwards due to strong base factor. Money supply is now declining and that could have an inflationary tendency in the near term.

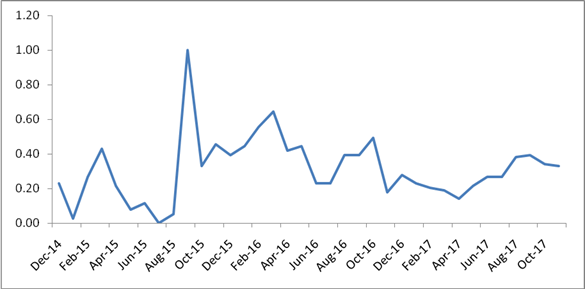

While considering the liquidity scenario, RBI’s net daily liquidly absorption through LAF operation in November is only Rs.718 billion, which was Rs. 2,229 billion in September and Rs. 1,400 billion in October. Our SLI shows that the liquidity conditions in the country have been continuously falling since the culmination of the demonetization exercise. The SLI, which incorporates the WACR and Repo measures the systemic liquidity represented by an index of 0 to 1. As per the latest data available, the index is approaching 0.5 as compared to less than 0.20 in April 2017. This resonates well with the worsening Credit to Deposit ratio, which at near the 80% level is at a historic high. This implies that there is no excess liquidity in the market. The MPC was cognizant of this development and held rates at status quo.As things stand today, SMERA reckons that the MPC is therefore unlikely to revise the repo rate in FY18.

Systematic Liquidity Index (SLI)

Source: RBI; SMERA Knowledge Centre

Domestic economy:

The recent GDP data hints a recovery in the economic activities, especially in the manufacturing sector. This is also supported by the November’s PMI number that stands at 52.6. Manufacturing hasbeen expanding by 7.6% during the Q2 FY18 reference period as compared to 1.2% value added growth last quarter. As understood, this sector has been subdued due to GST related volatilities as well as cheaper imports.Agriculture sector, on the other hand, shows an average performance during kharif harvest on account of skewed distribution of monsoon and unseasonal rainfall. Consequently, food grain production saw a (-)3% contraction during kharif season in FY18. The services sector too, a prime driver of GDP growth is growing below its five-year annual average. The sector is slowing because of the real estate,which has been a major contributor in its growth. Real estate has been reeling under the implementation of RERA and GST lately. Considering these factors, RBI upholds its GDP growth expectation at 6.7% growth for FY18. As per our assessment in September 2017, the economy is expected to post 6.8% in FY18.

Repo rate and CPI inflation rate

Source: RBI; MOSPI; SMERA Knowledge Centre