17 Apr 2021

KEY TAKEAWAYS

|

India’s merchandise deficit widened to USD 13.9 bn in Mar-21 from USD 12.6 bn in Feb-21. The increase in the magnitude of deficit appears stark in comparison to the Mar-20 (month that saw the beginning of the global spread of COVID pandemic and the lockdown driven economic disruption) print of USD 10.0 bn. The incremental expansion of merchandise trade deficit in Mar-21 was accompanied by a relatively higher increase in imports vis-s-vis exports.

For FY21 as a whole, exports and imports clocked USD 290.6 bn (-7.3%) and USD 389.2 bn (-18.0%) respectively. With imports contracting more than exports, the merchandise trade deficit eased significantly in FY21 to USD 98.6 bn from USD 161.4 bn in FY20. Moving on to the recent print, lets assess the drivers of trade deficit in Mar-21.

Exports: A new monthly record

In value terms, exports clocked a record high of USD 34.5 bn (60.3% YoY) in Mar-21 vis-à-vis USD 27.9 bn in Feb-21. At a granular level:

Imports: Scales a new peak in tandem

Merchandise imports also touched a record high monthly print of USD 48.4 bn in Mar-21 (53.7% YoY) vis-à-vis USD 40.5 bn in Feb-21.

Conclusion

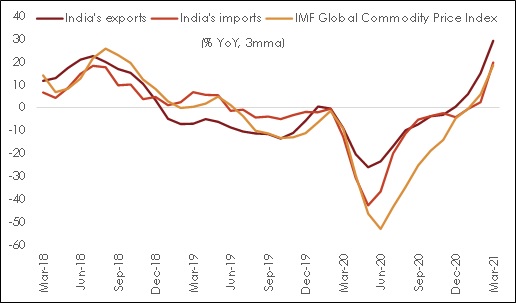

We had pointed out earlier that India’s merchandise trade deficit has normalized vis-à-vis pre COVID levels. We stick to that assertion and continue to expect further normalization (i.e., significantly higher trade deficit vis-à-vis 3.7% of GDP estimated for FY21) during the course of FY22. However, we also note that a part of this normalization has transpired on the back of price effect (and it would be fair to say that so was the aberration during the initial months of COVID). In fact, over the last 20-years, changes in international commodity prices explain nearly 70-79% of changes in India’s imports and exports, with rest on account of adjustment in volume.

Having said so, there is also reason for optimism with respect to improved outlook on international trade volume. As per the IMF, world trade volume is expected to expand by 8.4% and 6.5% in 2021 and 2022 respectively post the 8.5% contraction seen in 2020. This rests on the belief that the V-shaped global economic recovery (supported by extremely accommodative monetary-fiscal policies and ongoing vaccination) would be led by manufacturing while services take a while longer for reaching their pre COVID levels, especially, in the context of multiple waves of infection across countries.

Nevertheless, there could be some minor disruption to trade activities in the near term with countries resorting to vaccine nationalism, reimposition of lockdown in select states in India throwing up logistical challenges, and lagged impact of the week-long traffic obstruction in the Suez Canal (the impact would have got partly captured in Mar-21 data).

Table 1: Merchandise Trade Balance

Chart 1: International prices have a dominant influence on India’s trade