KEY TAKEAWAYS - India’s merchandise trade deficit moderated slightly to USD 19.7 bn in Oct-21 from its all-time high of USD 22.6 bn in Sep-21 but continues to remain elevated.

- The moderation in trade deficit was on account of sequential increase in exports to a record high while imports posted a mild decline on monthly basis.

- While some of the factors behind elevated trade deficit such as a surge in gold imports may fade away in the coming months, others like the complete unlock of the economy and high vaccination coverage would support domestic demand in the quarters ahead leading to continued rise in non oil and non gold imports.

- Meanwhile, exports are poised to touch government’s full year target of USD 400 bn in FY22, given that it is averaging USD 33.4 bn in the first seven months of the current fiscal.

- We stick to our FY22 current account deficit forecast of USD 38 bn vis-a-vis a surplus of USD 24 bn in FY21

|

India’s merchandise trade deficit moderated to USD 19.7 bn in Oct-21 from its all-time high of USD 22.6 bn in Sep-21. The moderation was on account of sequential increase in exports to a record high while imports posted a mild contraction on monthly basis. Overall, the normalization in economic activity is underscored by continued improvement in India’s external metrics with total exports and imports climbing up well above their pre-pandemic levels. With conclusion of the first seven months of FY22, cumulative trade deficit stands only marginally lower at USD 98 bn vs. USD 100 bn in the corresponding pre-pandemic period of FY20.

Exports: At an all-time high

In value terms, merchandise exports touched a record high of USD 35.6 bn in Oct-21 from USD 33.8 bn in Sep-21 led by increase in both oil and non-oil exports. This translates into an annualized growth of 43.1% YoY to mark the eighth consecutive month of strong growth.

- Cumulative export for the first seven months of FY22 stands at USD 233.6 bn, a growth of 26% as compared to the corresponding pre-pandemic period of FY20.

- The average monthly exports in the first seven months of the current fiscal stands at USD 33.4 bn which is 28% higher than the monthly average in the pre-pandemic year of FY20. Even if we consider non-oil exports where realizations have increased, the growth in the monthly average of non-oil exports have been 26% compared to FY20.

- Robust external demand has been recorded in sectors such as chemicals, pharmaceuticals, iron and steel, textiles, and engineering goods.

- The near complete unwinding of lockdown restrictions by states since the beginning of Jun-21 accompanied by a V-shaped global recovery, besides support from accommodative policies, structural reforms like the PLI Scheme, and elevated commodity prices has led to a structural improvement on the export front.

Imports: Moderate, but remain elevated

Merchandise imports slightly moderated to USD 55.4 bn in Oct-21 from USD 56.4 bn in Sep-21, translating into an annualized growth of 62.5% YoY. At a granular level:

- The marginal dip in total imports was led by moderation in crude oil imports (USD 14.4 bn) with uptick recorded in non-oil and non-gold imports (NONG) (USD 34.9 bn). Gold imports continued to remain relatively high at USD 5.1 bn in Oct-21.

- The decline in oil imports is a bit perplexing given surge in global crude oil prices by 12.3% MoM to USD 82 pb in Oct-21, indicating that the moderation in oil imports could have been driven by decline in oil import volume.

- Meanwhile, NONG imports- a key indicator for domestic demand, touched an all-time high level rising by USD 1.6 bn from the previous month to USD 34.9 bn led by machinery & electrical goods, chemicals, and metals. However, we remain watchful of recovery in imports beyond Q3 FY22 in order to gauge the sustenance in demand beyond the festive led improvement.

- For Apr-Oct’21, total imports have risen by 16% as compared to Apr-Oct’19 reflecting a pickup in industrial demand and increase in commodity prices.

Outlook

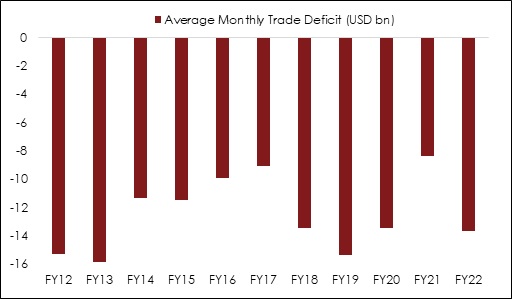

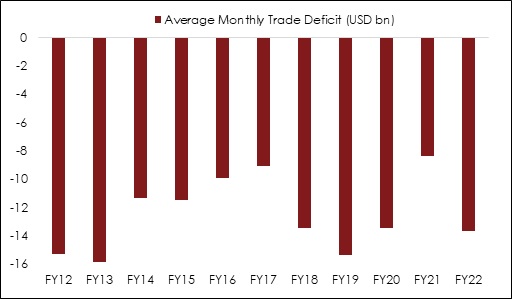

Moderation in trade deficit from record high levels comes as a respite and is along expected lines as outlined in our previous month’s report on external trade. However, we do note that despite moderation, the monthly trade deficit continues to remain elevated – the average trade deficit on FYTD basis (Apr-Oct) currently stands at a 3-year high of USD 13.7 bn. The monthly average for the year is likely to move further higher in the coming months as:

- Domestic economy continues to move towards normalization amidst ongoing tapering of lockdown restrictions by states. As per high frequency Google Mobility Indicator, the aggregate individual level mobility after returning to pre pandemic levels in Oct-21 has made further gains thereafter. In addition, the inoculation coverage continues to improve (partial and complete coverage stood at 54.1% and 26.8% of total population as of Nov 15, 2021) notwithstanding the moderation in momentum post opening of vaccine exports by the government. Although, most economic indicators could appear to be losing momentum on annualized basis in H2 FY22 due to statistical distortions from base effect, sequential changes like ongoing unlock and vaccination coverage would hold greater relevance for domestic demand, and hence the trade deficit.

- Covid related domestic supply disruptions could continue to persist in the near term, thereby keeping upside pressure on import of certain electronic items, edible oil, and coal.

- Last, but not the least, is the role of international commodity prices. Since end Aug-21, the generic natural gas price has risen by ~71%, coal price by 40-45%, crude oil price by ~19%, besides persistence of upside pressure seen in case of edible oils, fertilizers, and aluminum. While this would aid both exports and imports, the impact on imports would be relatively higher on account of the size and composition of the overall basket.

Meanwhile, the comforting factor for external trade is the traction in exports. Going by the current trend, India appears to be well placed to achieve government’s FY22 target of USD 400 bn. In the medium to long term, exports could find support from domestic PLI schemes besides ongoing global economic recovery.

In the near term, we continue to stick to our FY22 current account deficit forecast of USD 38 bn compared to USD 24 bn surplus in FY21.

Table 1: Key items within merchandise trade balance

Chart 1: The average monthly trade deficit in FY22 (so far) is already at a 3-year high