KEY TAKEAWAYS - IIP growth posted a mild downtick to 3.2% YoY in Oct-21 from 3.3% in Sep-21 with the actual print turning out to be softer than market expectation of 3.6-4.1%.

- Nevertheless, signals from overall assessment appear relatively balanced with shades of optimism as Oct-21 IIP print was marked by strong seasonal and sequential outperformance along with relatively healthy expansion compared to pre Covid levels.

- Out of 25 industries covered by the IIP, 16 posted a sequential expansion in Oct-21 (vs. 11 in Sep-21), while 9 saw a sequential contraction (vs. 13 in Sep-21), highlighting an improvement in the breadth of industrial activity.

- Our expectation of headline IIP growth drifting towards lower positive levels is currently playing out amidst fading of favorable statistical base effect after the initial part of the fiscal.

- The moderation in IIP growth may also amplify due to sequential easing of certain support factors with festive season coming to an end, deceleration in export momentum, and a potential threat from Omicron led surge in Covid infections.

- However, pent-up demand, vaccination coverage, government spending, and continued support from accommodative monetary policy would help buoy sequential industrial activity.

- On balance, we continue to retain our FY22 GDP growth forecast at 10.0% with possible downside risks.

|

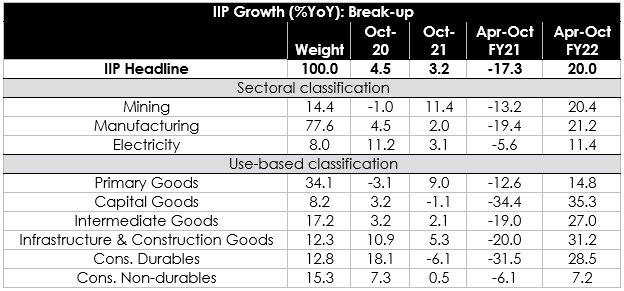

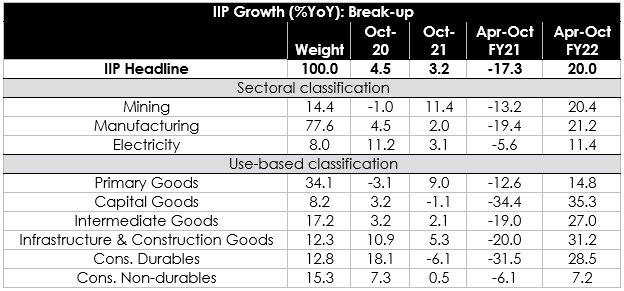

India’s industrial production posted a mild downtick to 3.2% YoY in Oct-21 from 3.3% in Sep-21 (revised up from 3.1%). The actual print for Oct-21 was weaker than market expectation of 3.6-4.1% (range of median consensus of various polls).

Despite the moderation in headline IIP growth, signals from overall assessment appear relatively balanced with shades of optimism.

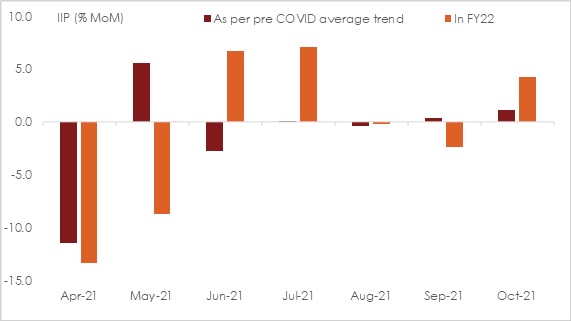

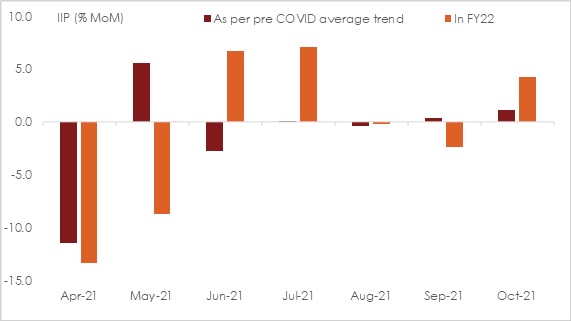

- On sequential basis, IIP expanded by 4.3% MoM in Oct-21 vis-à-vis an expansion of 1.1% seen on average basis in the month of October (2012-2019). In fact, a cursory observation suggests that in general, the sequential momentum in IIP has been outpacing its pre Covid trend post the second wave of infections during Apr-May FY22.

- Going beyond the statistical base effect distorted by the pandemic, we note that Oct-21 IIP is 7.8% higher vis-à-vis Oct-19 levels, thereby underscoring the recovery in overall industrial activity on a 2-year basis.

Key granular details

- Out of 25 industries covered by the IIP, 16 posted a sequential expansion in Oct-21 (vs. 11 in Sep-21), while 9 saw a sequential contraction (vs. 13 in Sep-21). This highlights an improvement in the breadth of industrial activity.

- On sectoral basis, the mining sector stood out in terms of sequential performance, registering a 7-month high growth of 15.4% MoM in Oct-21. The mining sector had seen extremely subdued sequential activity in H1 FY22 on account of the second wave of Covid followed by a backloaded rainfall during the south-west monsoon season. The conclusion of the monsoon season and taper down of the Covid wave (accompanied by increased vaccination coverage) is now helping the mining sector to recoup earlier loss in momentum.

- The manufacturing sector rose by 3.4% MoM in Oct-21 after two consecutive months of sequential contraction in output. Sequential activity was led by the following industries: (i) Coke and Refinery, (ii), Paper, (iii) Non-Metallic Minerals, and (iv) Food Products.

- On use-based side, both primary and intermediate goods posted a sequential expansion after two consecutive months of contraction in output. Investment oriented sectors saw an expansion led by infrastructure & construction goods while consumption oriented sectors saw a moderation led by contraction in consumer durables.

- Infrastructure and construction goods saw a superior performance with healthy sequential and annualised growth of 6.1% and 5.3% respectively due to the pickup in construction activity led by increased government capital expenditure. A weakness is visible in both consumer durables and non-durables output which highlight slack rural demand that hopefully will improve with the harvest of the kharif crop.

Outlook

Our expectation of headline IIP growth drifting towards lower positive levels is currently playing out amidst fading of favorable statistical base effect. This could get amplified by sequential easing with certain support factors such as festive heavy season coming to an end, moderation in export momentum, and a potential threat from Omicron led surge in Covid infections in the world, including India.

Meanwhile, the drag from global supply chain disruptions in case of energy items and semiconductors is likely to persist in the near term, although the peak concern could now be behind us. Notwithstanding, the recent correction in crude oil prices, prices of other commodities continue to remain elevated impacting input prices and margins.

If the threat from Covid remains subdued in the coming months, then sequential momentum in industrial production could still find support from:

- Progress on vaccinationAt present, India has inoculated 59% with single dose and fully vaccinated 37% of its population. As partial coverage nears two third of the population by year-end, it should provide a strong boost to consumer sentiment and demand recovery, esp. the unlocking of pent-up demand.

- Strong government spendingAs of Oct-21, central government’s cumulative expenditure touched 52.4% of FY22 budget estimates (9.9% YoY) vis-à-vis 47.3% of actuals (0.4% YoY) in the corresponding period in FY21. Revex is now likely to get disbursed at a higher pace in H2 FY22 to meet budgetary targets as well as demand for unallocated items (like Covid related expense, fertilizer subsidy, wage hikes, MGNREGS enhancement, etc.). Meanwhile, Capex is on an accelerated mode with Apr-Oct FY23 growth at 28.3% YoY vis-à-vis a contraction of 1.9% seen in the corresponding period in FY21.

- Continued monetary policy supportThe RBI reiterated its growth supportive stance in Dec-21 policy review until the recovery becomes durable, strong, and inclusive. Omicron related risks appears to have delayed the beginning of the interest rate normalization in India, as of now.

Taking all the above factors into consideration, we retain our FY22 GDP growth forecast at 10.0% with downside risks.

Annexure-1

Chart 1: Sequential momentum in IIP has been outpacing seasonality effects

Table 1: IIP growth at a glance