22 Oct 2019

As per a study conducted by Acuité, the overall revenue of OEMs is expected to decline 23-25% YoY in Q2FY20. As a result, the sector’s contribution to Gross Value Addition (GVA) of the country will also drop – leading to an overall decline in its GDP contribution. As per the Government of India’s automotive mission plan, the sectors contribution was targeted to reach 12% by the year 2026. As recent as 2018-19, the sector had attained a size equivalent to 7.5%. We note that this number is likely to decline to 7% in FY20. The understanding is influenced by the fact that the sector follows the push model, wherein the OEMs drive the entire automotive ecosystem. Consequently, any decline in revenue and sales of these entities will directly impact the auto ancillary players and dealers as well.

Our analysis reveals that the FY20 total domestic sales will decline by (-) 6 - 7% YoY to approximately 25 million units. Revenue of the sector may also decline by (-) 5 - 6% YoY to Rs. 3 – 3.2 trillion as compared to the previous year’s Rs. 3.35 trillion. In Q2FY20, we expect the revenue to be in the vicinity of Rs. 0.6 trillion as compared to Rs. 0.8 trillion the previous year- recording a decline of 23-25% YoY.

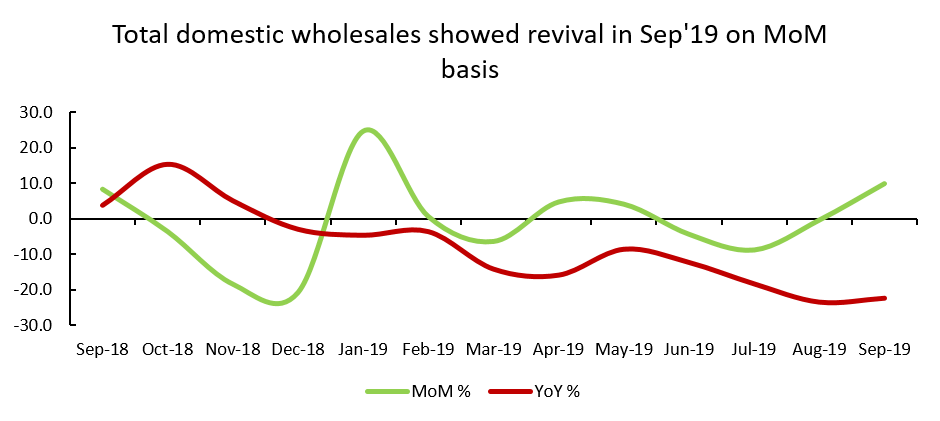

Trends are evident in Sep’19 total wholesale domestic sales, which declined by 22.4% (YoY) to 2 million units as against 2.58 million units in the same month last year. However, the total sales showed a growth of 10.1% MoM in the same period indicating a somewhat revival in the industry. All the segments including passenger vehicles (PV), commercial vehicles (CV), two wheelers (2W) and three wheelers (3W) showed MoM growth of 13.6%, 12.6%, 9.4% and 12.4%. However, despite this relatively stellar performance, we are sceptical that the September sales has succeeded in reviving the fortunes of the sector in Q2FY20.

One exception to the rule has however been utility vehicles (UV’s), a segment that showed 5.5% YoY growth on back of new launches. We note that the growth in UV segment in an overall slowing market is indicating a change in consumer preferences towards higher value added and exciting products.

Festive season unlikely to alleviate market sentiment

Acuité believes that the continuously weak sentiment among consumers may not provide respite even during the festive season and the overall automobile industry sales are expected to remain below similar periods in the past. Recent trends in retail sales indicate that despite high discounts and offers, major players in the industry had failed to attract buyers for purchasing vehicles even at the onset of festival season. Nevertheless, we reckon that the month of October may see better inventory turnaround and higher sales on a MoM basis.

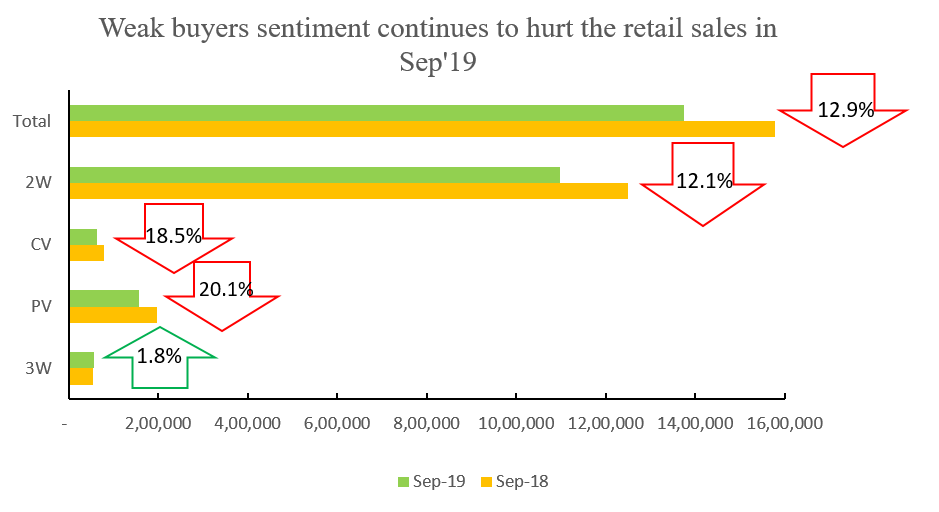

As per the data provided by automobile dealers body Federation of Automobile Dealers Associations (FADA), the total retail sales across all the segments declined 12.9% to 1.37 million units in Sep’19 as compared to 1.58 million units in the same month last year.

Weak rural demand one of the primary reasons for the slowdown

The worst decline can be seen in sales of passenger vehicle (PV) segment falling 20.1% to 157,972 units in Sep’19 against 197,653 units same month last year. 2-wheelers (2W’s) sales on the other hand fell by 12.1% to 1.1 million units against 1.25 million units in same month last year (YoY). This is in line with Acuité assessment, which shows that as of Q1FY20, ~40% of 2Ws sales are contributed by India’s rural market.

Decline in retails sales in the segment therefore reflects the persistence of poor demand in rural areas despite festive occasions such as Onam followed by Navratri. Commercial vehicles (CVs) retail sales fell 18.5% YoY with ongoing slowdown in the economy negatively affecting capital good consumption and investments. The increase in axle load last year by the government has also restricted fleet operators towards purchase of new vehicles, impacting sales of newer vehicles. However, 3-wheeler (3W’s) showed a marginal improvement of 1.8% YoY in the same period.

Inventory levels marginally higher in anticipation of festive sales; may add to the stress

Acuité is with the view that the festive season will give an opportunity to the dealers for effective inventory turnover in Oct’19; the next such window will be available not before March 2020. As per data from FADA, the inventory level continues to be on the same level in Sep’19 for 2W segment with an average inventory level of 60-65 days. The inventory level for PV has slightly increased to 30-35 days in Sep’19 against 25-30 days in Aug’19 with expectation of higher sales during festive season. On the other hand CV inventory levels have slightly reduced from 55-60 days in Aug’19 to 50-55 days on account of clearing BSIV vehicles before the transition to BSVI in April’20.

Going forward, pre-buying of vehicles is anticipated in H2FY20 before transition to BSVI emission norms along with an expectation of initiatives from the Indian government pertaining to further GST rationalizations and the much awaited scrappage policy. We note that while these initiatives may go some way in alleviating the problem, there seems to be a change in consumer preference, which is in turn a bigger consideration here. The current slowdown may have been triggered by economic uncertainty, the structural issue may have roots firmly attached to the fact that the market is reorganizing itself and the sector must evolve, keeping track with this change.