KEY TAKEAWAYS - While wholesale inflation climbed to over a 3-decade high of 15.88% YoY in May-22, retail inflation trajectory has been divergent, moderating by 75 bps to 7.04% YoY in May-22.

- Sequentially, however, both WPI and CPI depicted a similar pattern, that of easing momentum in May-22; the absolute degree of monthly price adjustments however remained strong.

- Food inflation continues to face challenges from summer seasonality and persisting supply side disruptions which have assumed a global scale.

- While fuel inflation eased in May-22 on account of excise duty relief provided by the government, buildup in international crude oil prices could once again keep the pressure intact, warranting further tax cuts.

- Meanwhile, core inflation pressures eased somewhat providing relief on both WPI and CPI metrics.

- Nevertheless, inflation risks continue to lurk on account of elevated commodity prices, further opening up of the economy and vaccination progress.

- Although we retain our FY23 CPI inflation at 6.5%, we do acknowledge that the balance of risk has once again tilted upside, mainly on account of further hardening of crude oil prices compared to our assumed baseline of USD 100 pb in FY23.

|

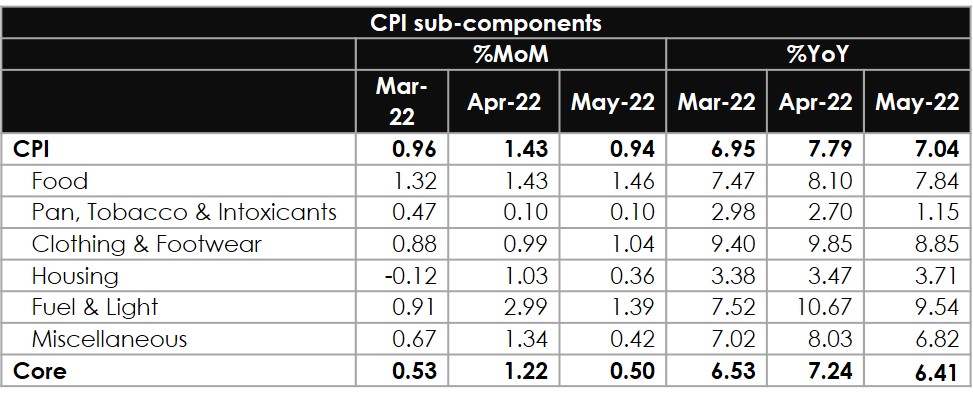

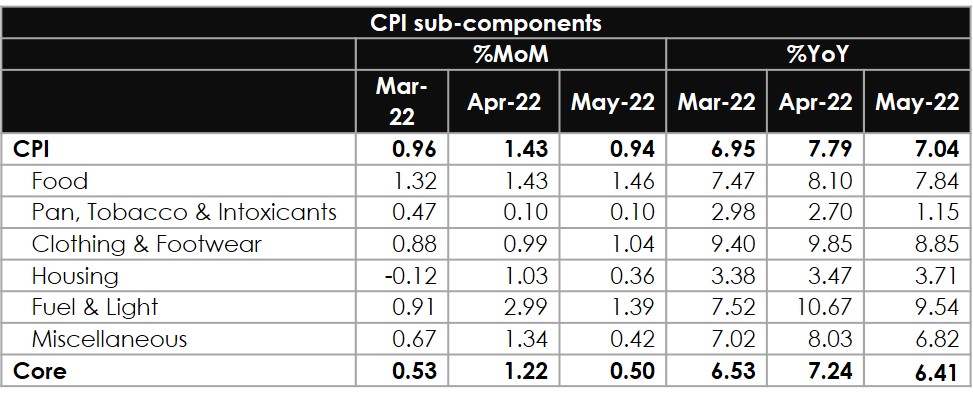

India’s CPI inflation moderated to 7.04% YoY in May-22 from 7.79% in Apr-22. The print in May was marginally softer than market consensus expectation of 7.1%. Nevertheless, it marked the fifth consecutive month of CPI inflation remaining well above the 6.0% policy tolerance threshold.

Key highlights of CPI inflation

- Sequential momentum moderated to 0.94% MoM in May-22 from 1.43% in Apr-22. Notwithstanding the moderation, sequential momentum remains moderately higher vis-a-vis the pre pandemic average of 0.67% MoM seen in the month of May.

- Food and Beverages index maintained a similar sequential momentum (1.46% MoM in May-22 vs. 1.43% in Apr-22). Incremental price pressures were predominantly led by Vegetables (5.23% MoM), Meat & Fish (2.46% MoM), and Spices (1.99% MoM). While this partly reflects the impact of adverse summer seasonality, factors like elevated agricultural input prices and second order effect of the spillover of the ongoing conflict between Russia and Ukraine have also played a role. Having said so, there are signs of partial respite from resumption of palm oil exports by Indonesia and imposition of domestic export ban on wheat.

- Sequential momentum in Fuel and Light index moderated to 1.39% MoM from 2.99% in Apr-22. The sequential drop in price of diesel, coke, and dung cake along with moderation in electricity, kerosene, and firewood price momentum provides comfort. However, coal and charcoal depicted signs of increased price pressure while LPG continues to carry over the strong momentum.

- Core (i.e., CPI ex indices of Food & Beverages, Fuel and Light) inflation momentum moderated to a 4-month low of 0.50% MoM from 1.2% in Apr-22 primarily led by transport and communication with easing of domestic pump prices of petrol and diesel due to cut in excise duties. Additionally, easing of pressure on Recreation & Amusement services and Personal Care products and the Housing index was also recorded. Meanwhile, sequential momentum in Clothing & Footwear index increased to a 12-month high of 1.04% MoM from 0.99% in Apr-22, manifesting the impact of hike in GST rate earlier in the year along with strong pickup in retail mobility in the post Omicron phase.

WPI inflation: Scales a new peakWPI inflation touched more than a three-decade high level of 15.88% YoY in May-22 vis-à-vis 15.08% in Apr-22. Sequentially, while the increase in headline index moderated from 2.01% in Apr-22 to 1.38% MoM in May-22, it nevertheless remains strong.

- The sequential momentum in consolidated food prices eased somewhat to 1.87% MoM in May-22 from 2.70% MoM, it nevertheless remains elevated on the back of summer seasonality and persistent global supply disruptions. As such, annualized consolidated food inflation touched a 29-month high of 10.66% in May-22 vs. 8.63% in Apr-22.

- The trend is similar in case of consolidated fuel prices that saw a moderation in sequential momentum to 3.24% MoM in May-22 from 4.20% in Apr-22 largely on account of excise duty relief. Nevertheless, the annualized fuel (consolidated) inflation inched up to a 6-month high of 45.75% in May-22 from 42.64% in Apr-22.

- Wholesale core inflation (non-food manufacturing inflation) moderated to 10.4% YoY in May-22 from 11.1% YoY in Apr-22 on the back of easing of sequential momentum to 0.50% MoM in May-22 from 1.0% in Apr-22.

OutlookThe moderation in sequential momentum in case of most items within CPI in May-22 offers some relief. Nevertheless, it would be premature to see this as a sustainable trend as overall sequential momentum continues to remain elevated.

- Post the cut in excise duty on petrol and diesel in May-22, international crude oil (India Crude Basket) price has jumped by nearly USD 9-10 pb levels to USD 119 pb currently in Jun-22. Although retail prices have remained unchanged since then, incremental buildup of under recoveries could eventually result in upward adjustment in prices by oil companies or a further buildup in fiscal headwinds via subsidies.

- The opening up of the economy, strong pick-up in retail mobility (to its highest post pandemic levels currently), and vaccination attaining critical mass (with 70% of the population having achieved two doses) is hastening the pass-through of elevated input prices. This is likely to provide stickiness to core inflation to around 6% levels.

- While the IMD expects the ongoing south-west monsoon season to clock 103% rainfall vs. the long period average, the onset and the initial progress in Jun-22 has led to some disappointment; of Jun 13, 2022, the cumulative deficiency stood at 37% of LPA vis-à-vis a cumulative surplus of 25% seen in the corresponding period last year. Adequate rainfall progress in the coming months would be crucial for kharif sowing and overall food inflation.

Having said so, the recently announced hike for kharif crops by an average of 5.9% (vs. last 3-year average of 4.0%) appears moderate amidst the backdrop of sharp pickup in agricultural input prices. This as per our estimates would provide subdued impact of 15 bps to FY23 CPI inflation as prices in the open market for some crops particularly for oilseeds (soyabean and groundnut) is already ruling above the revised MSP for FY23 kharif season.

Although we retain our FY23 CPI inflation at 6.5%, we do acknowledge that the balance of risk has once again tilted to the upside, mainly on account of further hardening of crude oil prices which currently hovers around USD 120 pb, compared to our assumed baseline of USD 100 pb in FY23.

Table 1: Key highlights of CPI inflation

Note: Core inflation excludes Food & Beverages, Fuel and Light from headline CPI.

Note: Core inflation excludes Food & Beverages, Fuel and Light from headline CPI.

Chart 1: Higher core inflation across wholesale and retail levels post pandemic

currently witnessing a slight moderation

.png)

+91 99698 98000

+91 99698 98000

.png)