KEY TAKEAWAYS - India’s CPI inflation surged to a 17-month high of 6.95% in Mar-22 vs. 6.07% in Feb-22. While market participants had expected a firming up of price pressures (consensus: 6.40%) in Mar-22, the upside surprise was sizeable given that it has not yet started reflecting the significant increase in the prices of retail fuel that have taken place from the last week of Mar-22.

- Mar-22 marked the third consecutive month of CPI inflation remaining above the 6.0% threshold, averaging at 6.3% for Q4 FY22.

- Sequentially, upside was primarily led by food and beverage inflation with the impact of Russia-Ukraine crisis already manifesting on prices of edible oils and wheat.

- For FY22, CPI inflation averaged at 5.5%, in line with our estimate and slightly higher than RBI’s earlier estimate of 5.3%.

- For FY23, we stick to our upwardly revised estimate of 5.9%, premised on the assumption of crude oil price averaging at USD 97 pb, adverse geo-political spillovers on food and other commodity prices and higher pass through of increased input costs in the prices of a broader range of goods and services amidst reopening up of the economy.

- While RBI has already taken cognizance of the rise in inflationary pressures in its latest monetary policy statement and restored the LAF corridor to 50 bps, the latest print in inflation may further translate into a hike in repo rates, sooner than later.

|

India’s CPI inflation surged to a 17-month high of 6.95% in Mar-22 vs. 6.07% in Feb-22. While market participants had expected a firming up of price pressures (Market consensus: 6.40%) in Mar-22, the upside surprise was sizeable given that increased retail fuel prices are still to be factored in the index. With this, Mar-22 marked the third consecutive month of CPI inflation remaining above the 6.0% threshold, averaging at 6.3% for Q4 FY22.

Key highlights

- Sequential momentum rose to 0.96% MoM in Mar-21 vs. 0.24% in Feb-22 to mark the highest pace of increment since Oct-21.

- The upside was primarily led by food and beverages, though price pressures were visible in all other sub-categories except for housing.

- Food and beverages index rose by 1.32% MoM in Mar-22, reversing the three consecutive months of decline over Dec-21 and Feb-22. Within food, price pressures were seen in Oils & Fats, Meat & Fish, Fruits, Spices, Milk, Prepared meals & snacks, and Cereals.

- As such, food inflation soared to a 16-month high of 7.47%YoY compared to 5.93% in Feb-22. Nearly a third of the increase in food inflation (i.e., 248 bps) was on account of the global spillover impact of the ongoing conflict between Russia and Ukraine and the resultant supply disruption in edible oils and cereals.

- Fuel and light rose by 0.91% MoM in Mar-22 to match the incremental pace of Feb-22. Once again, the stronger momentum was led by Kerosene prices that saw a double-digit upward adjustment.

- Core momentum (i.e., CPI ex indices of Food & Beverages and Fuel and light)) rose by 0.53% MoM in Mar-22, pushing annualized core CPI inflation significantly to 6.53%. Price pressures were strong in both Clothing & Footwear and Miscellaneous sub-categories.

- Annualized inflation for Clothing & Footwear spiked to 9.40% which is a record high, led by hike in GST rate on footwear along with higher demand for summer clothing with the rise in temperatures, in addition to mobility getting restored and some emergence of pent-up demand.

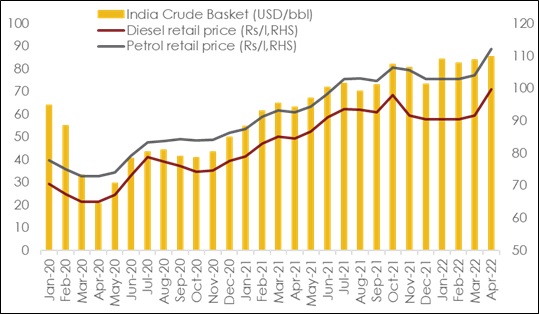

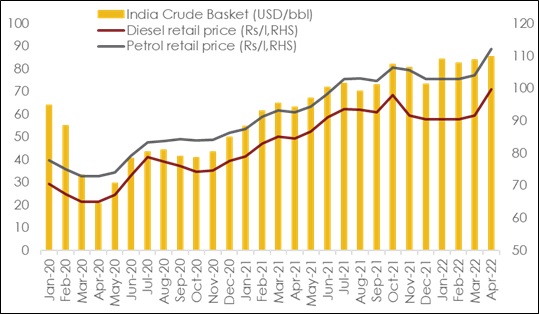

- Miscellaneous inflation too rose to a 9-month high of 7.02%YoY, partly led by petrol, diesel prices within Transport & Communication, Gold within Personal Care & Effect along with a generalized rise in demand for goods and services amidst reopening up of the economy post Omicron wave. However, it is to be noted that the complete effect of the rise in retail pump prices of petrol and diesel is yet to be reflected in the CPI print since the bulk of the increases of around Rs 10-12 per liter (so far) has taken place in Apr-22

OutlookThe headwinds from rise in commodity prices due to the continuing geopolitical conflict between Russia and Ukraine have already started to manifest in India’s inflation trajectory. Higher prices of retail fuel will translate to higher transportation costs for food and other products, leading to a potential rise in prices in those categories. Further, global supply disruption in food products such as wheat and edible oil, have started to impact the domestic prices of these products. For FY23, we stick to our upwardly revised estimate of 5.9%, premised on the assumption of crude oil price averaging at USD 97 pb, adverse global spillovers on food and other commodity prices and core inflation remaining firm amidst opening up of the economy. Our forecast, though includes a fiscal buffer in the form of a cut in excise duty of Rs 5 each on petrol and diesel each (For further details, refer our "Acuité Macro Pulse” for Mar-22

https://www.acuite.in/macro-pulse.htm). Reflecting impact of the Russia-Ukraine war, the RBI too in its recent policy upped its FY23 inflation forecast sizeably close to our estimate at 5.7% from 4.5% earlier.

Looking ahead, Apr-22 CPI inflation reading is likely to remain elevated amidst non-core price pressures from –

- Stronger pass-through of crude oil prices to retail consumers in Apr-22. Recall, price adjustments had begun towards the end of Mar-22, with cumulative upward adjustment amounting to close to 1.0% in the month. In comparison, so far in Apr-22 (as of 13th Apr), diesel and petrol price have been adjusted up by 8.8% and 7.8% respectively.

- Food price pressure from perishables especially fruits and vegetables are likely to mount with the onset of the summer seasonality a little earlier than usual, adding to the global price pressures already brewing in case of edible oils and cereals. This could potentially warrant some government intervention in the form of draw-down of excess buffer stock/export restrictions in case of wheat. The manifestation of the anticipated normal monsoon will be critical to keep domestic food price pressures in check. As per IMD’s Long Range Forecast for the 2022 Southwest Monsoon Season Rainfall released on 14 Apr-22, for the country as a whole, rainfall is likely to be normal at be 99% of the Long Period Average (LPA) with a model error of ± 5%.

We continue to expect the RBI to hike repo rate by 50 bps in FY23, given the domestic inflationary pressures, the rise in interest rates in the developed economies and the higher sovereign borrowings. Looking at the projected trajectory of inflation and growth, we expect that the central bank may take such action in tranches between June and March FY23. Having said so, further acceleration in global commodity prices could potentially tilt the balance in favor of another 25-bps repo rate hike (not our baseline scenario as of now).

Annexure

Table 1: Key highlights of CPI inflation

Chart 1: A lagged adjustment in retail petrol & diesel prices begun Mar-22 onwards

+91 99698 98000

+91 99698 98000