KEY TAKEAWAYS - India’s CPI inflation moderated in Jul-22, to 6.71%YoY from 7.04% in Jun-22, to mark the first print below 7.0% in four months. This is also the third month in succession that the YoY print has recorded a decline.

- Sequential CPI momentum eased to the lowest level in 5 months, with downward momentum for Food and beverages with deceleration seen in price of Vegetables, Edible oils, and Meat & fish.

- After averaging at 7.3% in Q1FY23, we expect CPI inflation to display some downside in the ongoing quarter, notwithstanding a marginal upward bias that months of Aug-Sep-22 may carry owing to an adverse base.

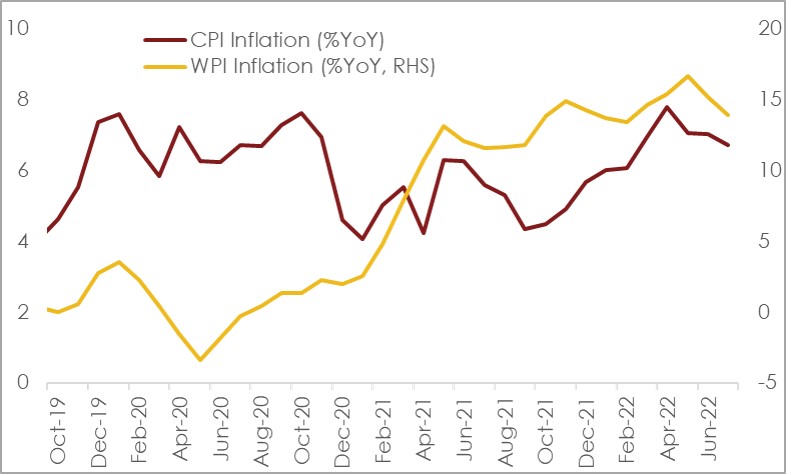

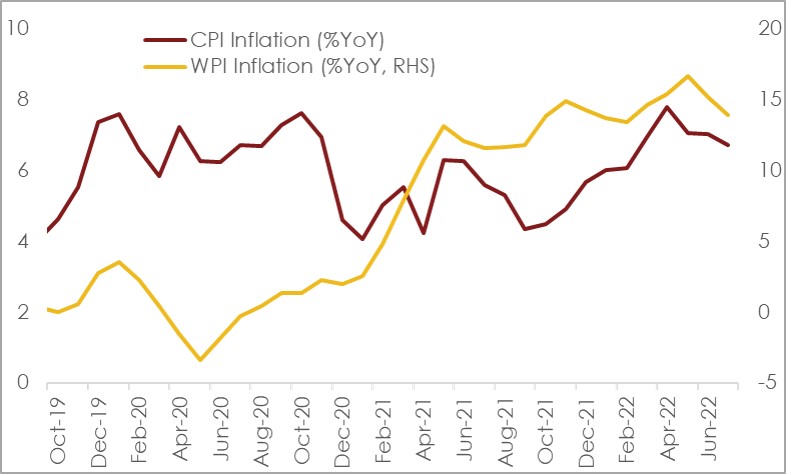

- WPI inflation eased to the lowest level in 5-months in Jul-22, coming in at 13.93%YoY compared to 15.18% in Jun-22. For the second month in a row, sequential momentum remained in contraction, the impact of which on the headline was exaggerated by a favorable base.

- The two positives of global commodity price moderation and a pick-up in Southwest monsoon rainfall continue to remain intact in Aug-22, so far.

- Despite this, we maintain our CPI inflation estimate at 6.7% for FY23, owing to the residual impact of rupee depreciation, pipeline inflation pressures (GST rate hikes etc.), uneven distribution of rainfall in some parts of the country and anticipated upside in services inflation due to pent up demand.

|

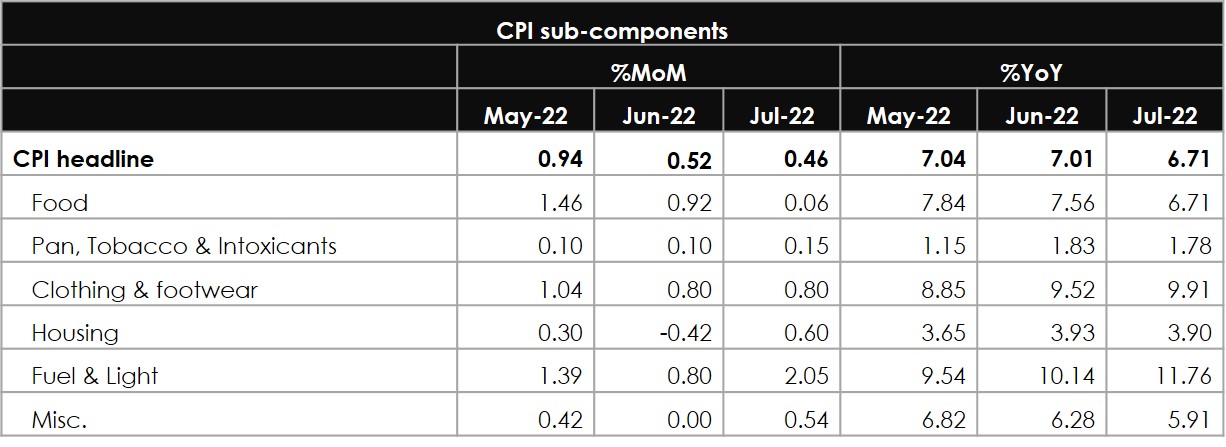

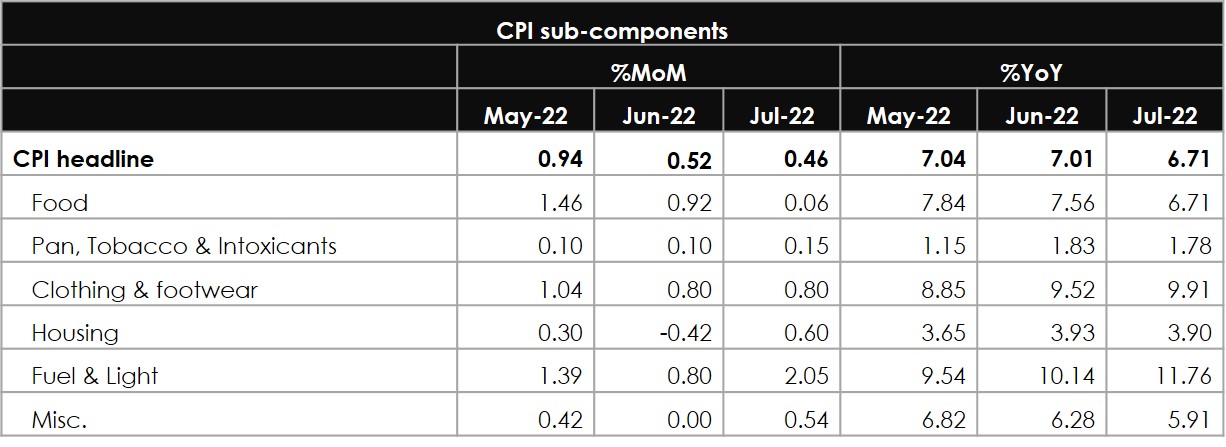

India’s CPI inflation moderated in Jul-22, to 6.71%YoY from 7.04% in Jun-22. This marked the first print below 7.0% in four months, and was broadly in line with market expectations (Reuters poll: 6.78%). After averaging at 7.3% in Q1FY23, we expect inflation to display some downside in the ongoing quarter, notwithstanding a marginal upward bias that months of Aug-Sep-22 carry, given an adverse base of the previous year.

Key highlights of CPI inflation

- Sequential CPI momentum eased further to the lowest level in 5 months, of 0.46%MoM in Jul-22 compared to 0.52%MoM in Jun-22 and an average of 1.11%MoM over months of Mar-May-22.

- Momentum for Food and beverages was substantially lower, at 0.06%MoM in Jul-22 compared to an average momentum of 1.28%MoM between Mar-Jun-22. The downside was led by a deceleration in price of Vegetables (-0.1%MoM, led by Tomatoes), along with Edible oils (-2.54%MoM) and Meat & fish (-2.92%MoM).

- In contrast, cereals momentum remained strong for the fifth consecutive month since the outset of the Ukraine-Russia war, primarily led by wheat and wheat products. As such, cereals inflation in Jul-22 stood at a near 2-year high of 6.90%YoY in Jul-22, nearly double of 3.46% from earlier this year in Jan-22. Going forward, the level of foodgrain stocks in the central pool will remain a monitorable.

- Consolidated fuel prices climbed up by a strong 1.53%MoM in Jul-22 with the impact of excise duty cut from May-22 waning out completely. While petrol and diesel prices eked small declines in Jul-22, sharp upward adjustment was seen in price of other fuel items such as Kerosene, Coke and LPG.

- Core inflation (CPI ex indices of Food & Beverages, Fuel & Light) momentum rose to 0.59%MoM in Jul-22, owing to a mean-reversion in Housing prices (after a seasonal dip in June), strong momentum in Clothing & Footwear along with a sizeable correction in gold and silver prices. While the annualized rate of core inflation remained above 6.0% in Jul-22, it has moderated to 6.04% from 6.22% in Jun-22.

Key highlights of WPI inflationWPI inflation eased to the lowest level in 5-months in Jul-22, coming at 13.93%YoY compared to 15.18% in Jun-22. For the second month in a row, sequential momentum remained in contraction, the impact of which on the headline was exaggerated by a favorable base.

- At a granular level, momentum for both Primary articles (-2.69%MoM) and Manufacturing (-0.42%MoM) registered a deceleration, partially offset by a sharp increase in case of Fuel and power (+6.56%MoM)

- Within Primary articles, the decline was almost broad-based with the exception of minerals, as moderation in price of vegetables and other commodity prices (such as cotton, oilseeds etc.) aided lower food and non-food prices.

- Index heavy-weight manufacturing WPI contracted by 0.42%MoM in Jul-22, building on the deceleration of 0.90%MoM recorded in Jun-22. The decline was broad based with 12 of the 22 sub-sectors registering a correction in price, led by Wood (-3.57%MoM), Food (-1.53%MoM), Paper (-1.22%MoM) among others.

- In contrast, Fuel and power registered a strong sequential momentum of 6.56%MoM in Jul-22, more than reversing the 5.01%MoM correction recorded in the previous month. The upside was led by Diesel (+18.4%MoM), Kerosene (+17.4%MoM), ATF (8.6%MoM) and Petrol (+7.6%MoM).

OutlookIn our last CPI report in Jul-22, we had highlighted the abatement of two risks – one, softness in global commodity prices and two, recovery in Southwest monsoon after a sluggish overture. Both these factors continue to remain in favor of a moderation in inflation trajectory, so far in Aug-22. To put this in perspective, CRB Reuters commodity index has eased by nearly 12% since its peak in early Jun-22 while cumulative rainfall up to 15 Aug, 2022 remains in a surplus of 9% versus the long period average.

Despite this, we continue to maintain our CPI inflation estimate at 6.7% for FY23, due to the following reasons –

- Impact of GST rate hikes on several food items of mass consumption (effectiveJul-22), along with hike in electricity tariffs by several states yet to get captured completely in CPI data.

- Pass-through of global commodity price correction on to CPI inflation is likely to be gradual and lagged. Further, the depreciation in the Rupee to the tune of 5.1%MoM on a FYTD basis stands to offset marginally some of these gains.

- Sowing of paddy in the ongoing Kharif season, as per Government sources, is lagging nearly 13% compared to last year owing to sizeable rainfall shortfall in key rice-producing states of Uttar Pradesh (-44%), Bihar (-39%) and Jharkhand (-36%). While Government’s rice stocks continue to remain above buffer norms, any shortfall in paddy production could put upward pressure on food prices.

- Services inflation could see an upside, amidst strong demand especially for contact-intensive services amidst complete normalization of economic activity.

Table 1: Key highlights of CPI inflation

Chart 1: Both, WPI and CPI inflation moved lower in Jul-22

Chart 1: Both, WPI and CPI inflation moved lower in Jul-22

+91 99698 98000

+91 99698 98000