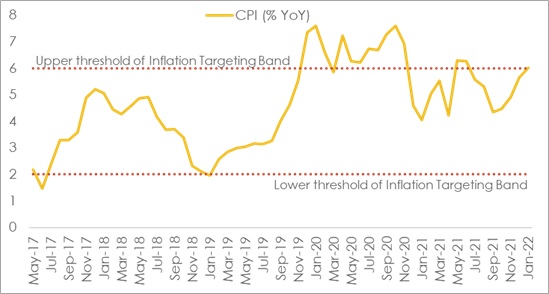

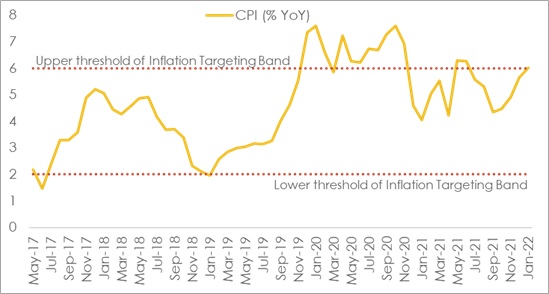

KEY TAKEAWAYS - Jan-22 headline retail inflation soared to a 7-month high print of 6.01%YoY from 5.66% in Dec-21 amidst waning of a favorable base albeit the index contracted sequentially by 30 bps.

- With this, CPI inflation now sits at the upper threshold of 6.0% of the RBI’s inflation target band, in line with our expectations.

- While food prices led the sequential decline, category of Clothing and footwear registered a strong uptick reflecting upward adjustment in GST rate (on footwear) along with ability of producers to charge higher prices for goods.

- WPI inflation eased slightly to 12.96%YoY in Jan-22 from 13.56% in Dec-21, marking the second consecutive month of moderation. Sequentially, the index rose by 0.35%.

- Looking at CPI inflation run rate for Apr-Jan FY22, we continue to hold on to our FY22 forecast of 5.5% vs RBI’s expectations of a 5.3% print.

- In our opinion, RBI’s estimate of 4.5% of CPI inflation for next fiscal year is understated owing to upside risks from commodity prices including crude oil, vaccination led demand side inflation, higher costs of imports due to currency depreciation risks and yet to reflect fully, the telecom tariff hikes. However, we foresee the moderation in headline CPI inflation to continue, albeit at a weaker pace.

|

On inflation front, the year 2022 has begun with the manifestation of the upside anticipated in CPI inflation. Jan-22 retail inflation soared to a 7-month high of 6.01%YoY from 5.66% in Dec-21 amidst waning of a favorable base, as incrementally the index contracted by 30 bps. With this, CPI inflation now sits at the upper threshold of 6.0% of the RBI’s inflation target band. It may be noted that the last time CPI was over 6% was in May-June’21 subsequent to the intense second Covid wave and the consequent supply chain challenges.

However, the headline print masks the second consecutive sequential decline of 0.3% in the index over Dec and Jan-22.

Key highlights:- The sequential decline was led by Food and Beverages prices that contracted by 1.1%MoM, building on 0.9% dip recorded last month. Leading this decline, were categories of vegetables (-7.4%), Oils and fats (-1.6%) and sugar and confectionary (-0.9%)

- Pan, Tobacco & Intoxicants prices too contracted for the second consecutive month, by 0.1% compared to 0.3% in Dec-21.

- Fuel and light index rose by a muted 0.1%MoM, driven by a 5.6% contraction in price of PDS kerosene in the month and in absence of any upward revision to retail fuel prices by oil companies ahead of the state elections.

- Among other movers, the index of Clothing & Footwear once again posted a strong momentum of nearly 1.0%MoM. Over the last three months, the category has registered an average price rise of 0.86%MoM compared to 0.60% over the previous three months. This reflects the hike in GST rate on footwear as well as the ability of producers to charge higher price for goods amidst increased retail mobility and strengthened demand.

- Telephone charges rose marginally by 1.6%MoM in Jan-22. Against nearly 20% hike in tariffs announced by telecom companies in Nov-21, the cumulative increase over Dec-21 and Jan-22 at 6.5% appears incomplete, which could mean lagged adjustment continuing into the coming month/s.

Core inflation (i.e., CPI ex Food & Beverages and Fuel & Light indices) increased by 0.56% MoM in Jan-22 vs. 0.23% MoM in Dec-21. While the annualized rate of core inflation remained unchanged at 6.19%, we note that it has averaged a little over 6% in last four months. Going forward, with increase in consumption demand on a durable basis, we expect a gradual pass through of input price pressures on to end consumers thereby keeping core inflation sticky at elevated levels.

WPI inflation: Moderates a tadWPI inflation eased further to 12.96%YoY in Jan-22 from 13.56% in Dec-21, marking the second consecutive month of moderation. Sequentially, the index rose marginally by 0.35% compared to a contraction of 0.90% in Dec-21.

- Looking at internals, annualized inflation for primary and fuel sub-components remained elevated, at 13.87% and 32.27% respectively with little change compared to previous month.

- Manufacturing inflation eased marginally into single-digits after a gap of 8 months to 9.42% from 10.62% in Dec-21

- On a sequential basis, primary articles’ prices eased by 1.67% in the month, led by contraction in food prices by a sizeable 2.61% amidst winter seasonal downside in vegetable prices.

- Fuel and power index rose by 3.90%MoM after contracting by a sharp 5.74% (owing to fall in petrol and diesel prices post duty reduction) in Dec-21, led by upward adjustment in price of electricity, petroleum coke and Naphtha. With India Crude Basket having risen by 25% since the beginning of 2022, fuel inflation is likely to remain elevated amidst lagged pass-through.

- In comparison, sequentially manufacturing prices saw a subdued uptick of 0.51% with lower month-on-month increment in price of chemicals, fabricated metals, paper and paper production vis-à-vis the recent past.

- Taking into consideration average inflation for Apr-Jan FY22, WPI inflation is clocking a run rate of 12.6% compared to 0.3% over the same period in FY21, fueling concerns of lagged pass-through to consumer prices, as demand recovery and vaccination progress happens further heading into FY23.

OutlookThe common thread emerging from both CPI and WPI inflation is the sequential moderation in price pressurLooking at the inflation trajectory so far, we continue to hold on to our FY22 forecast of 5.5% where the risks of any significant deviation is limited. The decline in inflation from 6.2% in FY21, has primarily been a function of relatively benign food prices (with third successive year of surplus monsoon), even though Fuel, Clothing & footwear sub-categories added to inflationary pressures amidst unlocking of economies (global and domestic respectively) in FY22.

While we expect a moderation in the headline inflation to 5.0% in our base case scenario for FY23, RBI’s estimate of 4.5% appears under whelming owing to the following upside risks which could also keep core inflation elevated:

- CPI inflation is yet to fully represent the complete impact of sharp hike in telecom tariffs in Nov-21.

- As severe tail risks on account of Omicron have receded, global commodity prices have firmed up sharply over Jan-22 and Feb-22 (so far), with price of India Crude Basket nearing USD 95 pb amidst flare up geopolitical tensions. This will result in a persistence of input price pressures.

- India has currently vaccinated 70% and 55% of its total population with first and second dose of vaccine. Continued progress on this front coupled with recovery in personal mobility post Omicron wave will continue to support pent-up/revenge demand.

- Volatile global capital flows due to monetary policy normalization in developed economies may keep the domestic currency under pressure and increase the cost of imports

- Higher statiscal risks of an irregular monsoon after three successive good monsoon seasons

- Possibility of future Covid waves with milder spillovers on supply disruptions

Annexure

Table 1: Key highlights of CPI inflation

Chart 1: CPI inflation yet again at the upper threshold of inflation band