16 Feb 2022

KEY TAKEAWAYS

|

India’s merchandise trade deficit moderated to USD 17.4 bn in Jan-22 from an elevated level of USD 21.7 bn in Dec-21. Both exports and imports contracted sequentially in Jan-22 amidst the global and domestic backdrop of rapid spread of the Omicron variant.

For the first ten months of FY22, cumulative trade deficit stands at USD 160 bn, higher than USD 141 bn deficit seen in the corresponding pre-pandemic period of FY20.

Exports: Broad based decline

In value terms, merchandise exports moderated to USD 34.5 bn in Jan-22 from its record peak level of USD 37.8 bn in Dec-21. This translates into a contraction of 8.7% MoM - this sequential contraction on account of Omicron uncertainty is relatively moderate in comparison to the previous Covid wave in Apr-21 that saw a 12.8% MoM contraction in exports.

Cumulative exports for the first ten months of FY22 stand at USD 335.9 bn, an expansion of 27.2 % compared to the corresponding pre-pandemic period of FY20.

Imports: Decline led by few key items

Merchandise imports eased to USD 51.9 bn in Jan-22 from its all-time high level of USD 59.5 bn in Dec-21, translating into a contraction of 12.7% MoM. At a granular level:

Cumulative imports for the first ten months of FY22 stand at USD 495.8 bn, an expansion of 22.3% compared to the corresponding pre-pandemic period of FY20, reflecting the pace of trade normalization despite the pandemic threat.

Outlook

The moderation in India’s merchandise trade in Jan-22 is a brief reprieve. Since it happened in the backdrop of escalation in most global commodity prices (barring fertilizers), the overall impact could be ascribed to lower demand, especially on the import front.

With the Omicron wave tapering at a rapid pace, states have begun to relax their lockdown restrictions. The test positivity ratio (on 7dma basis) has dipped from its peak of 17.6% on Jan 26, 2022 to 3.7% on Feb 15, 2022. If this declining trend continues, then the likelihood of near complete phasing out of lockdown restrictions in the next 2-weeks cannot be ruled out. This will once again stoke pent-up demand in the economy, which would also find support from year-end seasonality. Combined with the impact from elevated global commodity prices (esp. crude oil, which has jumped by ~23% in 2022 so far), we anticipate the pressure on imports to resurface.

A similar rationale would also benefit India’s exports, which seems poised to exceed government’s USD 400 bn target for FY22 comfortably.

On net basis, the merchandise trade deficit could remain elevated as the recent surge in global commodity prices would have an adverse impact on India’s terms of trade. Hence, if current levels of commodity prices hold (or increase further) in the near term, then our estimate of India’s current account deficit of USD 46 bn in FY22 could face a mild upside risk.

Table 1: Highlights of merchandise trade balance

Note: Numbers may not add up due to rounding off and revision in headline exports and imports

Chart 1: Global shipping rates, though still elevated, have started to cool down

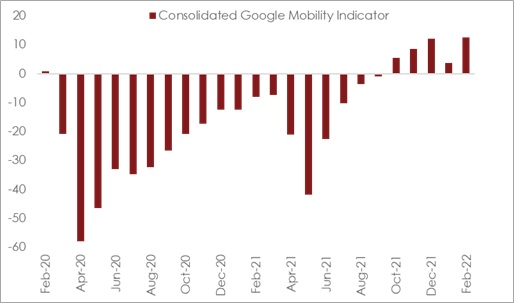

Note: The consolidated indicator is an average of mobility changes on account of Retail & Recreation, Grocery & Pharmacy, Parks, Transit Stations, Workplaces, and Residential.