03 Mar 2022

KEY TAKEAWAYS

|

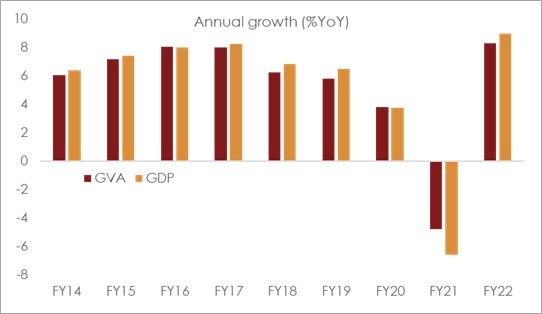

India Q3 FY22 GDP growth decelerated more than expected to 5.4% YoY from 8.5% in Q2 (consensus: 6.0%). On sequential basis, however GDP expanded by a healthy 6.4%QoQ, underscoring an unfavorable base weighing on headline growth. Along with Q3 FY22 GDP the National Statistical Office (NSO) published FY22 GDP second advance estimate which stands revised lower at 8.9% compared to 9.2% provided in its preliminary estimate. The downward revision reflects the upward adjustment to FY21 GDP (i.e., the base) along with a moderate impact of the Omicron wave. Basis NSO’s annual estimate, the estimated Q4 FY22 GDP growth stands at 5.3% YoY i.e., almost unchanged versus Q3. Although the economic impact of the third Covid wave was limited as compared to the previous pandemic waves, some loss of momentum in economic revival particularly in contact intensive services amidst the spread of Omicron in Jan-22, persistence of supply chain bottlenecks and sharply higher international crude oil prices and emerging geo-political risks is expected to marginally weigh on Q4 GDP growth.

Key highlights

FY22 growth and outlook for FY23

Although not very significant, the Omicron wave dented the pace of growth recovery that posted a good run post the second Covid wave amidst a mix of pent-up, festive and some organic demand. However, the silver lining to the outlook comes from relatively lower severity of the Omicron wave with cases having peaked rather quickly amidst robust vaccination coverage, prevailing level of seroprevalence, improvement in medical and healthcare facilities and better management of supply chain logistics. In addition, vaccination coverage continues to power ahead with over 80% of the adult population having been double vaccinated. Further, the monetary as well fiscal policy environment also remains conducive for overall economic growth.

That said, the pace of economic revival in the near term is clouded once again on the back of ongoing geopolitical strife between Russia and Ukraine that has created an additional stress on an already elevated commodity price scenario and existing supply chain bottlenecks. As per RBI’s assessment, a 10% sustained increase in crude oil price pulls down on average India’s GDP growth by 0.2%. Additionally, the scale back of fiscal and monetary policy support in most developed economies, and the financial market volatility (amidst rising interest rates and prospects of quantitative tightening) could impact capital flows and weigh on overall growth momentum in the next couple of months.

Overall, given the revision to FY21 GDP data and consequently a less favourable base for FY22, our GDP growth estimate for FY22 has been revised lower to 9.2%, although still marginally higher than the NSO estimate of 8.9%. We believe that the backloaded government expenditure in Mar-22, RBI firmly in accommodative mode along with the further scope of pent up demand due to the taper of the pandemic may offset some of the downside risks. In addition, in nominal terms, FY22 GDP growth revised up to 19.4% from 17.2% projected earlier, offers added support. The FY22 fiscal deficit estimate stands adjusted lower to 6.7% of GDP from 6.9%, thereby providing some fiscal buffer to the government to enhance spending or cut fuel taxes amidst emergence of geopolitical risks.

For FY23, we expect GDP growth at 7.5% amidst government’s strong thrust on infrastructure segment as highlighted in the Union Budget FY23, high penetration of vaccination, moderate recovery in rural consumption and the full play out of pent-up demand although it is likely to be partly offset by high crude oil prices and higher than expected inflationary pressures.

Table 1: India’s GVA and GDP: Sectoral break-up

Chart 1: India sees a V-shaped growth recovery