25 Sep 2017

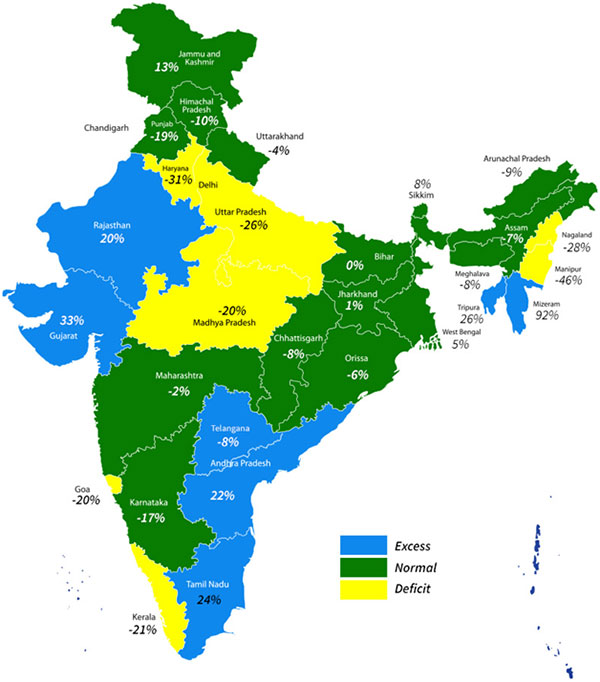

Keeping pace with expectations, the southeast monsoon has recorded 692.2 mm rainfall during June- August, 2017, which is -3.05% lower than the long period average. Rainfall during these three months is crucial for the productivity of kharif crops.

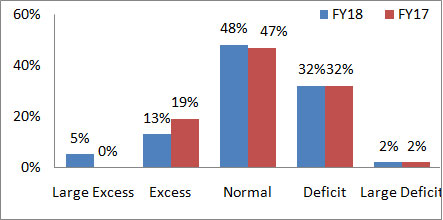

The cumulative rainfall was 696.4mm during the corresponding period in FY17. Overall, the cumulative rainfall during the monsoon season for past two years is almost same. However, a sub-division wise rainfall distribution shows five per cent of subdivisions received 60% excess rainfall than the LPA in FY18. As a result, some regions have been affected by floods and it has led to loss of crops. In FY17, on the other hand, there was no evidence of excess rainfall. This shows that the weather condition in FY18 is marginally less favourable for kharif crops.

Subdivision wise cumulative rainfall distribution:

Source: Indian Meteorological Department (IMD), SMERA Knowledge Centre

Note: Large Excess is ≥ 60% of LPA, Excess is ≤60% and ≥20%, Normal is ±19%, Deficit is ≤-20% and ≥-59%, Large Deficit is ≤- -20% as defined by the IMD.

Production:

Area under sown has reached 1041.2 lakh hectares till first week of September, which is (-) 0.8% less as compared to the corresponding period the previous year. We expect the area under sown to reach 1058.7 lakh hectares by end of this kharif season. The sales of certified seeds are positive during this season. High breed seeds production of paddy for kharif FY18 has recorded 11% growth. Similarly, seeds production in pulses has recorded 8-15% growth. We therefore believe that fall in area under sown is likely to be offset by the growth in sales of hybrid seeds. Considering these facts, SMERA expects the overall food grain production to grow by 0.08% in Kharif season FY18. This had recorded a robust growth of 10.7% in FY17.

Similarly, sugarcane and cotton are likely to witness a solid growth rate of 9.3% and 21.3% respectively in FY18. Area under cultivation for these crops dropped to a 7-year low in FY17 and put upward pressure on prices. Cotton production recorded 9.7% growth in FY17 despite a fall in area under sown by (-) 12.4%. The higher growth in cotton production is attributed to the sowing of hybrid seeds. Therefore, the crop is expected to post similar yield in FY18 as well. The other segments in agriculture sector such as horticulture, floriculture and livestock are also likely to post healthy growth in FY18. Therefore, we expect the overall agricultural GVA to post around 3.5% in FY18.

Trend in production of major crops during kharif season:

Source: Ministry of Agriculture, GOI, SMERA Knowledge Center

Note: production in million ton;* is SMERA estimates, # is growth in crops in FY18 over previous year

Price movement:

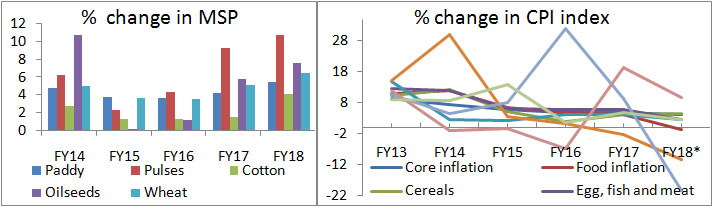

Overall, the food inflation in FY17 was under control with the healthy growth in agricultural output and efficient supply chain management. The agriculture sector is expected to post healthy growth in FY18 as well. SMERA, therefore, expects food inflation to remain around 3% only.

The pulses price in CPI index has been growing at a negative growth due to surplus production and base factor. However, price of the commodity is likely to remain stable in FY18. Another anomaly in FY17 was spike in sugar price. The sugar price has increased by 19.6% in FY17 due to fall in sugarcane production. As the crop has long gestation period of close to one year, SMERA believes that expected higher production in FY18 will help in controlling price next year only.

Change in Minimum Support Price (MSP) and CPI index:

Source: CMIE, SMERA Knowledge Center

Note: * is April - July, # is growth in FY18 over previous year; Change in MSP for pulses and oilseeds is calculated by formulating index price

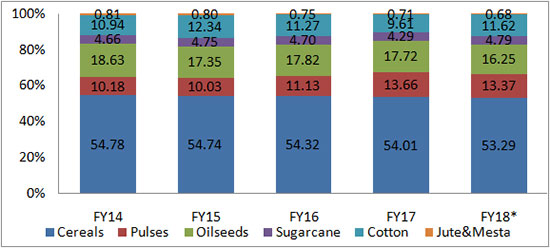

Cropping pattern:

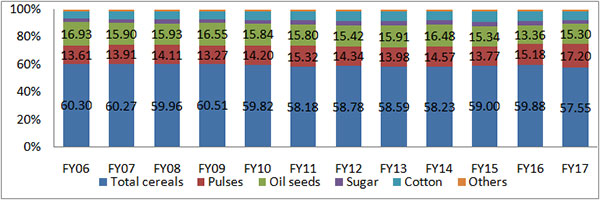

Cropping pattern over past five years shows a shifting from cereals production to pulses. Pulses share in overall sown area during kharif season has increased from 10.2% in FY14 to 13.7% in FY17 (however, share has marginally dropped to 13.4% in FY18). Share of cereals (including rice and coarse cereals), oilseeds and jute & mesta in overall sown area, on the other hand, has been falling gradually. The overall sown area (including kharif and ravi season) also shows similar trend. Area sown for cereals has dropped from 60.3% of overall sown area in FY06 to 57.5% in FY17. Area sown for pulses, in contrast, has increased 13.6% of overall sown area in FY06 to 17.2% in FY17.

Share of major crops in total sown area during kharif season:

Source: RBI, Ministry of Agriculture, GoI, SMERA Research

Share of major crops in total sown area:

State-wise cumulative rainfall during June 1, - August 31, 2017