WPI inflation too inched up mildly to 13.11% YoY in Feb-22 from 12.96% in Jan-22. Sequentially, the index rose by a strong 1.40% MoM compared to a sequential contraction of 0.28% each seen in the previous two months.

- Primary food prices rose by 1.09% MoM in Feb-22. Sequential contraction in food prices were more than offset by sharp increase in prices for crude petroleum & natural gas, non-food items, and minerals.

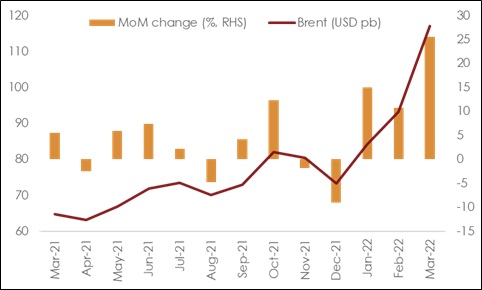

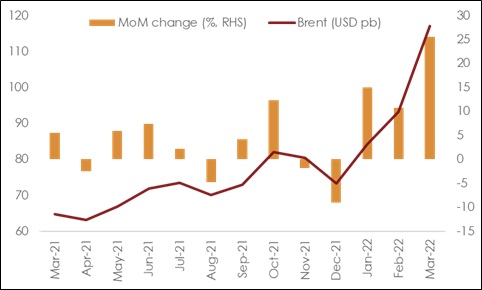

- Fuel & Power index jumped up by 4.35% MoM in Feb-22, led by higher price of ATF, Kerosene, Naphtha, Bitumen, Furnace Oil, along with petrol and diesel for industrial users. This reflects the partial impact of sharp jump in price of India Crude Basket to USD 93 pb in Feb-22 from an average level of USD 78 pb in Dec-21 and Jan-22.

- Core inflation (headline WPI excluding food & beverages and all forms of fuel items) rose to 11.25% YoY in Feb-22 from 10.66% in Jan-22. The monthly sequential momentum printed at a strong level of 1.02%. This is the third instance of more than 1% MoM increase in core WPI inflation in FY22 so far and is reflective of elevated imported price pressures.

OutlookBoth CPI and WPI inflation in Feb-22 resonate similar messages, that of gradually creeping annualized rate of inflation, powered by moderate to strong sequential momentum. It is not surprising that the sequential momentum is relatively higher in case of WPI vis-à-vis CPI, since the former captures the rise in commodity and energy prices better.

We continue to stick to our FY22 forecast of 5.5%. The decline in inflation from 6.2% in FY21, has primarily been a function of softer food prices (with third successive year of surplus monsoon), even though Fuel and Clothing & footwear sub-categories added to inflation pressures amidst reopening of economies (global and domestic respectively) in FY22.

Going forward, we expect a potential increase in oil production from other OPEC+ countries and the US along with probability of easing sanctions on Iran, to help rein in spiraling crude oil prices and ease supply shortages. However, it would take some time for the prices to moderate on the back of escalating tensions with US and UK banning oil imports from Russia. As such, while the import dependency on Russian energy is limited, many allies of Russia could join the bandwagon thereby affecting supplies and keeping oil prices elevated. Additionally, existing low levels of oil inventories which had been depleted due to the pandemic and limited ability of some oil producing countries to ramp-up production due to years of underinvestment could further hamper the oil supplies. Overall, in our base case we expect oil price to average in the range of USD 85-90 pb in FY23 higher than USD 70-75 pb pegged in the Union Budget FY23 and in the inflation forecasts of RBI.

For FY23, inflation drivers are likely to face considerable pressure from persistent hardening of input prices. What started as a supply side disruption (exacerbated by elevated transportation costs and aided by recovery in global demand) in major part of FY22, later gave way to a spike in geopolitical risk premium on account of the ongoing conflict between Russia and Ukraine. While heightened uncertainty on account of geopolitical risk has primarily impacted energy prices, there is considerable stress in case of few other commodities like fertilizers, select food items, semiconductors, precious and few industrial metals, etc. However, on the assumption of a normal monsoon we had pegged our inflation forecast of 5.0% in FY23 although the upside risks are on the rise. There is a scope for upward revision in the forecast if crude oil prices were to stay elevated for a prolonged period.

Annexure

Table 1: Key highlights of CPI inflation

Chart 1: Sharp rise in crude oil prices in 2022 so far will weigh upon CPI inflation

+91 99698 98000

+91 99698 98000