21 Mar 2022

KEY TAKEAWAYS

|

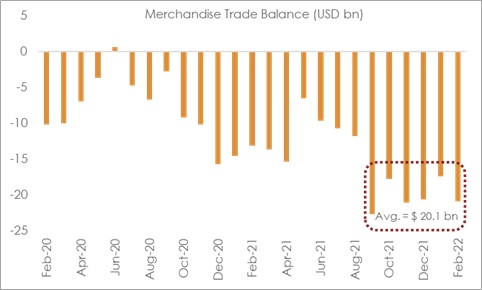

India’s merchandise trade deficit widened to USD 20.9 bn in Feb-22 from USD 17.4 bn in Jan-22. Post the sequential contraction in Jan-22 on account of the Omicron wave, both exports and imports rose in Feb-22, with momentum in imports exceeding that of exports.

For the eleven months of FY22, cumulative trade deficit stands at USD 176 bn, higher than USD 151 bn deficit seen in the corresponding pre-pandemic period of FY20.

Exports: Broadly steady and set to exceed USD 400 bn in FY22

In value terms, merchandise exports moved up just a tad to USD 34.6 bn in Feb-22 from USD 34.5 bn in Jan-22. This translates into a modest increase of 0.2% MoM over the 12.1% sequential contraction seen in Jan-22 on account of Omicron related uncertainty.

Cumulative exports for the eleven months of FY22 stand at USD 375 bn, an expansion of 28.4 % compared to the corresponding pre-pandemic period of FY20. The aggregate merchandise exports for the current fiscal are set to exceed USD 400 bn, a target set by the Commerce Ministry.

Imports: Picks up post Omicron

Merchandise imports increased to USD 55.5 bn in Feb-22 from USD 51.9 bn in Jan-22, translating into a growth of 6.8% MoM. At a granular level:

Cumulative imports for the eleven months of FY22 stand at USD 551 bn, an expansion of 24.2% compared to the corresponding pre-pandemic period of FY20, reflecting some pent up demand, higher commodity prices and the normalization on the trade front with gradual economic recovery.

Outlook

As highlighted in our previous month’s trade note, the moderation in India’s trade deficit in Jan-22 turned out to be temporary (on account of Omicron led disruptions and uncertainty). Pressure on trade deficit mounted once again in Feb-22 as both exports and imports re-captured the impact of pent-up demand along with higher global commodity prices.

While exports are set to exceed government’s target of USD 400 bn in FY22, imports are also poised to exceed USD 600 bn level in FY22, thereby resulting in total merchandise trade crossing USD 1 trillion mark for the first time.

That’s a commendable feat for India in a year marked by Covid related supply and demand challenges. Having said so, we also need to be cognizant of the significant tailwinds to merchandise trade from elevated global commodity prices. However, high commodity prices also turn out to be a headwind for trade and current account deficits respectively since India is a net importing economy.

In the February edition of "Acuité Macro Pulse” report we had revised up the forecast for FY22 current account deficit to USD 50 bn from USD 46 bn earlier. This did not take into account the surge in global commodity prices on account of geopolitical conflict between Russia and Ukraine that started later in the month.

Basis the surge in commodity prices since the last week of Feb-22, we now see a minor upside risk (of USD 2 bn) to our FY22 current account deficit forecast of USD 50 bn.

For FY23, we assume Brent crude price to stay around USD 97 pb levels (which is imputed by taking the average of monthly futures for the next 12 benchmark contracts). We project FY23 current account deficit to widen to USD 85 bn. The expectation of widening of current account deficit is not just based upon the likelihood of elevated global commodity prices, but it also is contingent upon the following factors to play a role:

We also acknowledge considerable uncertainty in projecting current account deficit due to high volatility in commodity prices, which in the current environment is taking cues from unpredictable geopolitical events. This broadens the uncertainty bands around our forecast.

Table 1: Highlights of merchandise trade balance

Note: Numbers may not add up due to rounding off and revision in headline exports and imports

Chart 1: Trade deficit reverts to elevated levels in Feb-22 after a reprieve in Jan-22