14 Apr 2022

KEY TAKEAWAYS

|

India’s IIP growth rose marginally to 1.7%YoY in Feb-22 from an upwardly revised print of 1.5% (vs. 1.3% earlier). Notwithstanding the modest increase, the IIP fell short of market consensus expectation of about 2.6% expansion.

On sequential basis, IIP contracted by 4.7% MoM in Feb-22, posting a deeper contraction than the seasonal average of 3.8% (average of last 5 years) for the month of February. This highlights some weakness in the industrial activity for second month in succession mainly due to lower than expected domestic demand in consumer products albeit this has to be seen in the context of lower working days in Feb-22. Sifting through the statistical base effect distorted by the pandemic, we note that Feb-22 IIP contracted by 1.6% vis-à-vis Feb-20 levels, thereby underscoring deeper weakness compared to pre pandemic levels.

A deep dive into internals

Outlook

Although India’s industrial activity did not reflect any direct significant of Omicron led disruption, the recovery thereafter has been subdued. The ongoing geopolitical crisis between Russia and Ukraine could potentially act as a dampener for certain sectors, esp. on account of acceleration in input prices, trade related supply disruptions, and the resultant weakness in global growth impulse (esp. Europe, which has extensive economic linkages with Russia and Ukraine). In addition, resurgence of Covid led disruptions in certain countries, esp. in China, could further compound uncertainties on the demand as well as supply front.

Reflecting these uncertainties, optimism in the manufacturing sector for Q1 FY23 moderated marginally in RBI’s latest round of industrial outlook survey "due to an ebb in sentiments on inventory of raw materials and finished goods”. Recent surveys conducted by other agencies (NCAER, CII, and FICCI) also indicate a sequential moderation in business expectations.

Meanwhile, support continues in the form of thrust on public capex (which is helping overall investment activity and exports to hold up despite headwinds), reforms under the "Atmanirbhar Bharat Abhiyan”, and an accommodative monetary policy backdrop. Improvement in manufacturing capacity utilization to 72.4% in Q3 FY22 (higher than its pre pandemic level of 68.6% in Q3 FY20) bodes well for future industrial activity. In addition, anticipation of a normal monsoon outturn (as per private weather forecasting agency Skymet, India could receive 98% rainfall compared to its long period average in the upcoming monsoon season) could provide relief in H2 FY23.

On balance, we continue to see moderate downside risk to our FY23 GDP growth forecast of 7.5%. Our base case growth forecast for FY23, rests on infrastructure spending highlighted in the Union Budget FY23, healthy progress on vaccination along with broadly accommodative monetary and fiscal policies. Geopolitics and its impact remain on close watch.

Annexure-1

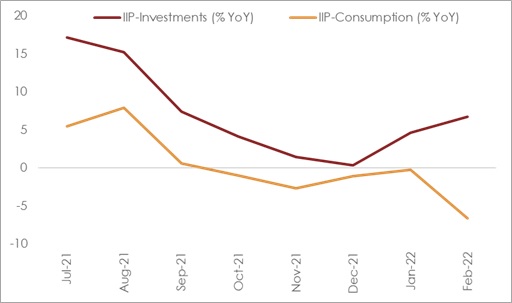

Chart 1: Divide between investment & consumption related industrial activity widens

Note: (i) IIP-Investments constitutes weighted average combination of the indices of Capital Goods and Infrastructure & Construction Goods, (ii) IIP-Consumption constitutes weighted average combination of the indices of Consumer durables and Consumer non-durables

Table 1: IIP growth at a glance