17 Dec 2018

India's macroeconomic outlook will start with a positive note in 2019. This is especially true given several national and international events soothing the volatilities that the economy faced for much of 2018. While the economy still has to deal with insecurities emanating from certain unresolved scenarios, the inherent resilience has never been starker.

On the domestic front, the barnacle of inflation seems to be under control and headline inflation number has been consistently undercutting targets. The RBI, which raised rates in accordance with its inflation expectations in June and August has suddenly realized the futility of its argument. With the hog cycles taking shape in India's food basket, food category inflation has been significantly impacting the overall number. At 39%, the category's weight in India's Consumer Price Index (CPI) is highest among peer nations, unduly influencing outcomes, which should rather be driven by a sticky core inflation. The RBI therefore expects headline inflation to remain range bound (3.9%-4.2%) by the end of FY19; it however expects the print of 4.5% in Q1 FY20. This latter figure continues to be RBI's medium term target level, which is a bit elevated. The downside risk of the situation is lower realizable prices for agriculturalists, who have to trade their produce at prices lower than even the set MSP creating high stress levels in the farm sector.

From the aggregate demand perspective, India remains the fastest growing major economy on earth. We expect the economy to print 7.5% in FY19, overall. While the Q2 number disappointed a bit, the consumption led story shows promise of sustainability. Having said that, Government expenditure remains the primary driver of growth with green shoots seen in capital formation. Nevertheless, a justifiable capex cycle is yet to start as the OBICUS survey reveals that capacity utilization levels have diminished to around 73% in H1 of the current financial year and there are elevated levels of raw materials to sales ratio. This could be a sign of hoarding at a time when commodity volatility is a reality due to global trade tensions. On the other hand, however, firms are positive about their pipelines and new orders. The IIP and Core industries too have been showing signs of consistency. Strong show by the manufacturing sector has been resonating well with the healthy consumer durable and non-durable consumption and demand for capital goods. We see a shift to higher value adding categories, augmenting growth. Also worth mentioning is the PMI manufacturing for November, which is at a 9-month high level. The index's two months lag with IIP augurs well for Indian manufacturing.

To maintain this strong growth however, systemic liquidity is key but the NPA crises has taken its toll on India's primary financiers, commercial banks. While offtake levels are strong, vulnerable sectors such as MSME have been facing difficulties in raising money. Nevertheless, the situation has been much better than that of Q3 FY18, when credit to deposit ratio was at an all-time high. Still, mandatory provisioning along with regulatory requirements has been sucking out the wind beneath the wings of commercial banking. The story of 11 banks under the Prompt Corrective Action (PCA) framework going out of action and the NBFC crises is worth telling too but things have evolved for the better after the RBI relaxed HQLA norms for the benefit of both.

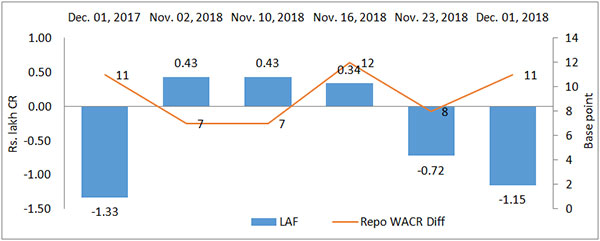

Liquidity then is one of the very core issues impacting macro stability and off course an important contention in the ongoing inter RBI-Government consultations. Allaying insecurities to an extent, the RBI has been infusing cash in the system regularly under its Rs. 1.3 lakh crore infusion plan for FY19. The WACR/ Repo ratio, which was actually negative in August this year, eased as a result. Ove the past five weeks, the ratio has been hovering in the vicinity of 7-12 bps, bringing about a semblance of security atleast in the money markets. Commercial Paper issuances have rebounded with over 35% growth YTD after sudden dip, starting H2. Credit growing faster than deposit is still a concern though and bank capitalizations are foreseen supporting in the medium term.

Another positive is the evolving scene in the capital markets, which have been languishing due to interest rate volatility and therefore a significant duration risk. For much of this year the issuances in the category were recording an over 30% decline but recently green shoots are seen. This is primarily driven by the fact that the RBI may return to a neutral stance by the next MPC meeting, given the benign inflation outlook as well as the cooling speech by the US Fed Governor. The market nonetheless continues to discount Indian debt higher than usual given the US/ India 10 year GSec differential and India 10 year GSec/ AAA Corporate Bond spreads remaining elevated. Going forward, yields are expected to ease further pulling down these differentials, adding issuances.

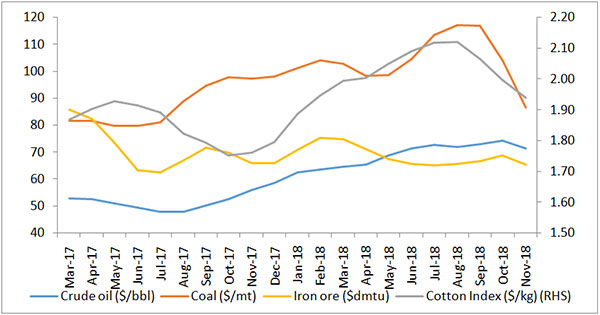

Talking about differentials and associated risks, one must not take down guard in a volatile environment. While there seems to be a consensus between US and Chinese trade negotiators and the muted allegations against Saudi King Mohammad Bin Salman, things seem desultory at best. The lack of consensus in the December 6th 2018 OPEC meeting regarding production controls (as well unfruitful negotiations with Russia) along with lack of American support for COP 24 are bigger risks to be considered. For now, oil prices along with other commodities have been stable and are somewhat aiding the current account balance of import dependent emerging markets such as India. However, the situation cannot be taken for granted as commodities have a bad habit of reverting to the mean at the slightest of chance.

Nonetheless, India today faces more domestic challenges than international. With national elections on the horizon along with the ongoing state elections, we remain vigilant on most macro-variables - especially the fiscal deficit. Having said that, the macro environment remains conducive for growth and expansion; the time to unleash the market's animal spirits has perhaps never been better.

Liquidity Conditions

Source: RBI; Note: Net injection (+) and Net absorption (-)

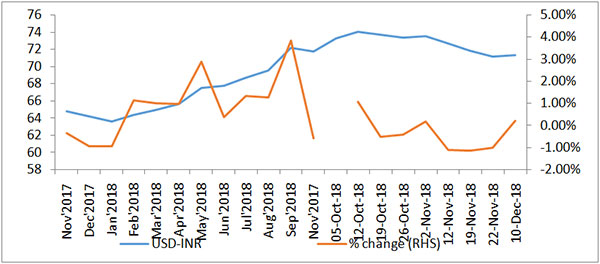

USD-INR Movement

Source: RBI, Acuité Research

Commodity Price Movement (3 Month Moving Average):

IIP growth (Economic base)

| IIP | Mining | Manu | Core | |

| FY15 | 4.02 | -1.34 | 3.75 | 4.94 |

| FY16 | 3.33 | 4.34 | 2.9 | 2.98 |

| FY17 | 4.58 | 5.33 | 4.32 | 4.76 |

| FY18 | 4.38 | 2.31 | 4.6 | 4.28 |

| Oct-17 | 1.83 | 7.64 | 3.8 | 4.73 |

| Apr-18 | 4.86 | 5.06 | 5.2 | 4.44 |

| May-18 | 3.21 | 5.7 | 2.79 | 4.65 |

| Jun-18 | 7.04 | 6.6 | 6.9 | 6.67 |

| Jul-18 | 6.61 | 3.35 | 6.96 | 6.63 |

| Aug-18 | 4.3 | -0.43 | 4.59 | 4.16 |

| Sep-18 | 4.47 | 0.21 | 4.62 | 4.28 |

| Oct-18 | 8.08 | 7.04 | 7.92 | 4.8 |