Expectation of complete normalization of economic activities driving rating upgrades

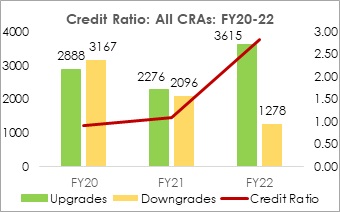

Acuité has undertaken a comprehensive analysis of the CRA industry rating migration data for FY22. Clearly, there is a very significant recovery in the [1]Credit Ratio (CR) of the industry to 2.83x in FY22 from 1.09x in FY21 and 0.91x in FY20 i.e. the pre-pandemic year respectively.

| All CRAs | FY20 | FY21 | FY22 |

| Upgrades | 2888 | 2276 | 3615 |

| Downgrades | 3167 | 2096 | 1278 |

| Credit Ratio | 0.91 | 1.09 | 2.83 |

Source: Prime-Acuité Rating Migration Database

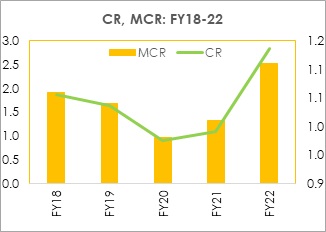

| FY18 | FY19 | FY20 | FY21 | FY22 |

| CR | 1.87 | 1.64 | 0.91 | 1.09 | 2.83 |

| MCR | 1.06 | 1.04 | 0.98 | 1.01 | 1.11 |

Source: Prime-Acuité Rating Migration Database

[1]CR is the ratio of upgrades to downgrades in a given period, non-cooperative issuers excluded

[2] MCR is the ratio of upgrades and reaffirmations to downgrades and reaffirmationsThe sharp upsurge in the Credit Ratio in FY22 which is a record high over the last ten years can be explained by the following:

- A resilient corporate performance in FY21-FY22 in a significant part of the manufacturing sector including lower debt levels vis-à-vis the apprehensions in the early part of the pandemic

- With healthy progress in vaccination and gradually declining risks of future waves of the pandemic, private consumption demand is expected to revive from H1FY23 and the ratings have started to factor in such a scenario

- Significant number of monetary policy measures taken by RBI since the outbreak of Covid which has helped the corporate and the financial sector to meet their funding requirements and stabilise their liquidity position

- Various relief measures announced by the Government of India importantly, the Emergency Credit Line Guarantee Scheme (ECLGS) and its further extensions which enabled banks to disburse additional funds to borrowers facing a working capital crunch

- Buoyancy in the export sector since H2FY21 which have partly offset the weak demand in the domestic sector

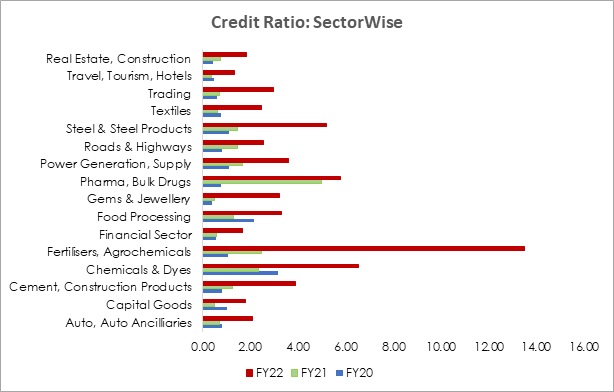

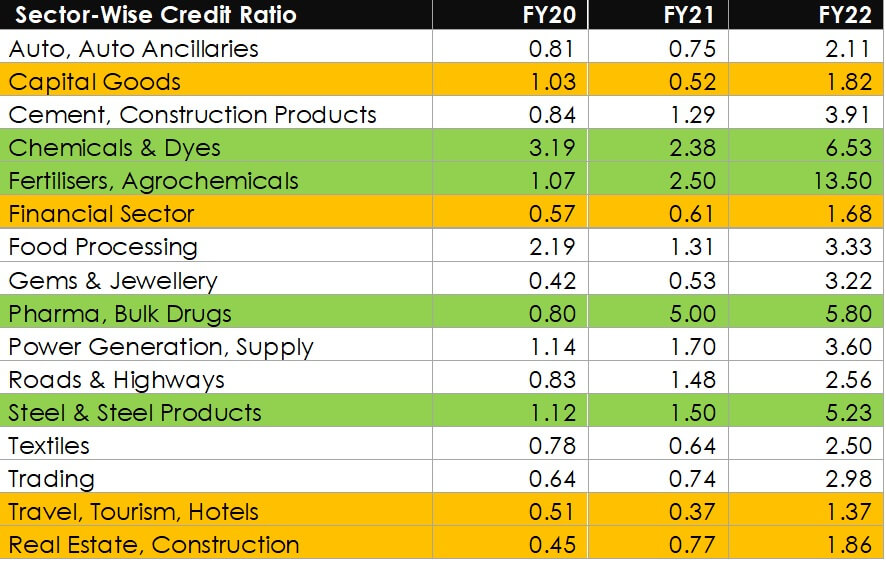

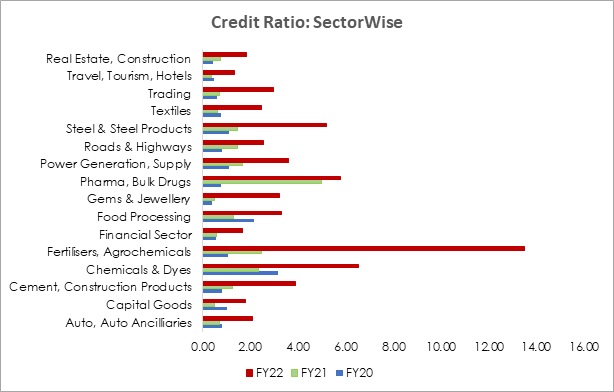

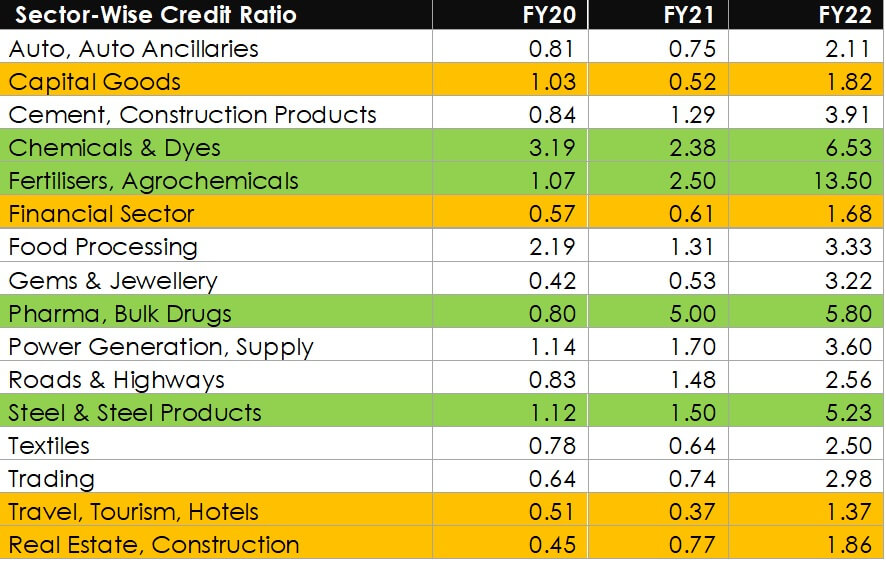

The credit ratio across the various sectors highlights the following aspects:

- In all the major sectors, upgrades exceeded downgrades by a significant margin, reflecting the expectation of a strong economic recovery over the medium term. Some of the downgrades effected earlier due to the pandemic impact, have been subsequently reversed and this is also captured in the enhanced credit ratio.

- There is a distinct recovery in the core infrastructure sectors with the focus on higher infrastructure investments leading to higher demand scenario in steel, cement, and power.

- With the removal of lockdown restrictions, the road sector has also started to see a recovery both in terms of project completion and toll collection.

- There is also a significant revival in sectors such as auto, gems and jewellery and textiles with expectation of a pent up demand.

- Few sectors such as chemicals, pharma and fertilisers were not only resilient to the economic disruption caused by the Covid pandemic but their business and financial position have strengthened over the last one year

- The improving credit ratio in the financial sector reflects a significant moderation in concerns on asset quality deterioration with improving monthly collections in the retail has also and the MSME loan portfolios. The liquidity for most NBFCs has also seen a distinct improvement, given the monetary and the fiscal support measures.

- The travel and the hospitality sector had been severely impacted during the pandemic as observed from the particularly low credit ratio in FY21 but with the declining intensity of the pandemic and the associated lockdowns, the prospects of these contact intensive sectors have improved, reflecting in higher pace of upgrades from H2FY22.

- There also appears to be an uptick in the capital goods sector due to a gradual pickup in both public and private sector capital expenditure from FY22 as well as due to the buoyancy in exports.

Says Suman Chowdhury, Chief Analytical Officer, Acuité Ratings & Research, "The sharp and broad based improvement in the credit ratio in FY22 was not really surprising given the visible domestic economic recovery particularly after the disastrous second pandemic wave in Apr-May’22. With limited impact of the Omicron wave, the operating environment for the contact intensive sectors have also seen a healthy revival in Q4FY22. We expect the momentum of upgrades to continue in FY23 amidst government’s strong thrust on infrastructure segment, solid coverage on vaccination, moderate recovery in rural consumption and the full play out of pent-up demand. However, a moderation of the record high credit ratio is on the cards with the headwinds from the Russia-Ukraine crisis, the high crude oil prices and higher than expected inflationary pressures which are likely to have an impact on the operating margins in the corporate sector.”

Annexure

Source: Prime-Acuité Rating Migration Database