KEY TAKEAWAYS - A study undertaken by Acuité Ratings on the latest quarterly financial performance of 1849 listed companies throws some interesting insights. While the large and the mid corporate sectors have shown a solid recovery in Q2FY22 after unlocking of the economy following the disastrous second Covid wave, the MSME sector still continues to lag behind.

- The resilience of the domestic corporate sector is reflected by the 23.6% growth in total revenues in Q2FY22 as compared to the pre-pandemic period i.e. Q2FY20. It also highlights a healthy revival in consumption demand after the removal of most lockdown restrictions and partly, the buoyancy in exports.

- It is interesting to note that the pandemic has actually led to a significant improvement in profitability of the overall corporate sector with more than 700 bps increase in the PBDIT margin in Q2FY21 YoY. We believe this is primarily due to the sudden drop in commodity prices and the rationalization of operating costs in the larger part of FY21. However, it is clear that such an improvement may not be sustainable given the steep hike in commodity costs including crude oil prices in the current year. We already note an average drop of 100 bps in PBDIT margin in the second quarter of the year and it is expected to normalise even further in H2FY22.

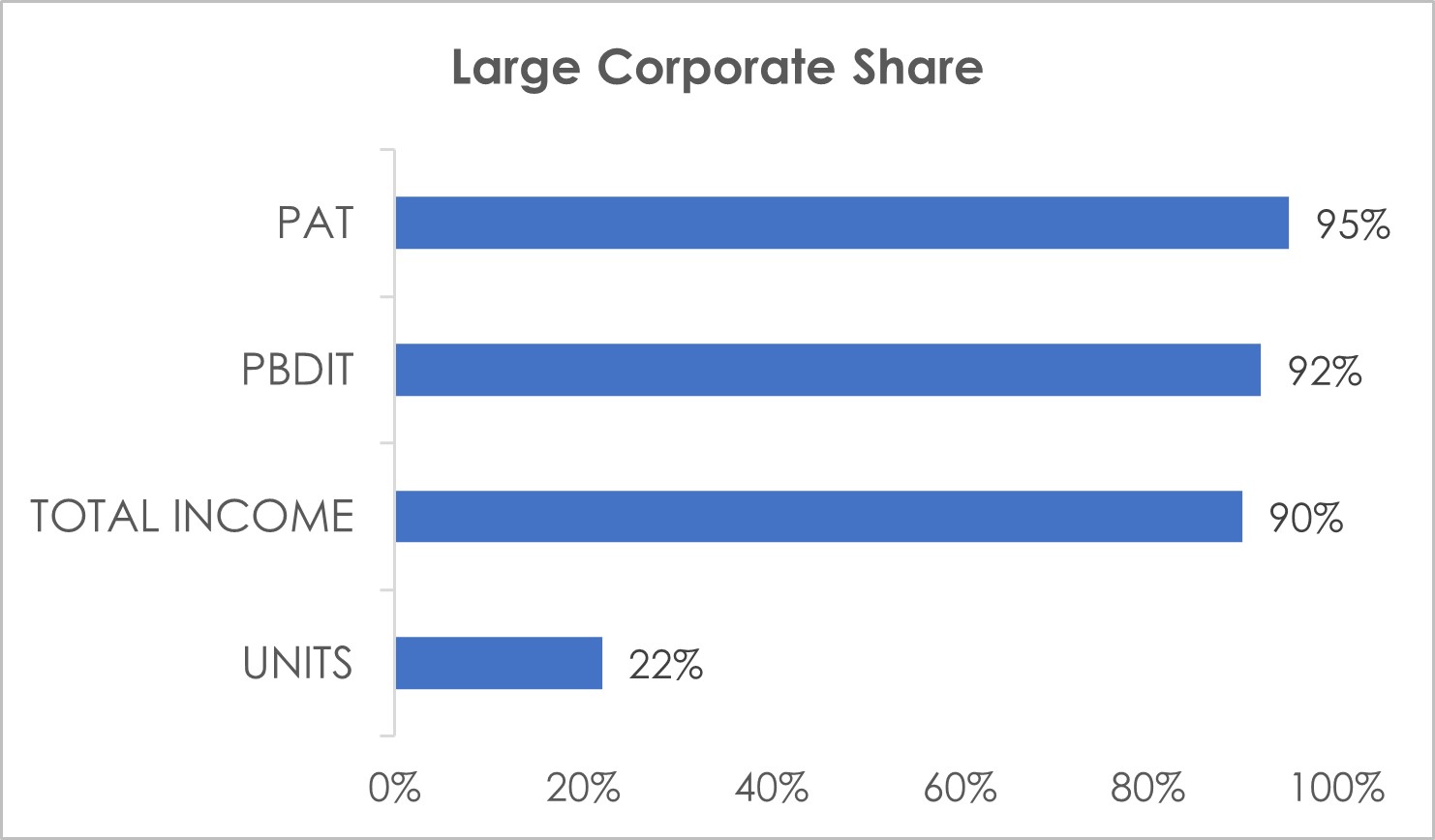

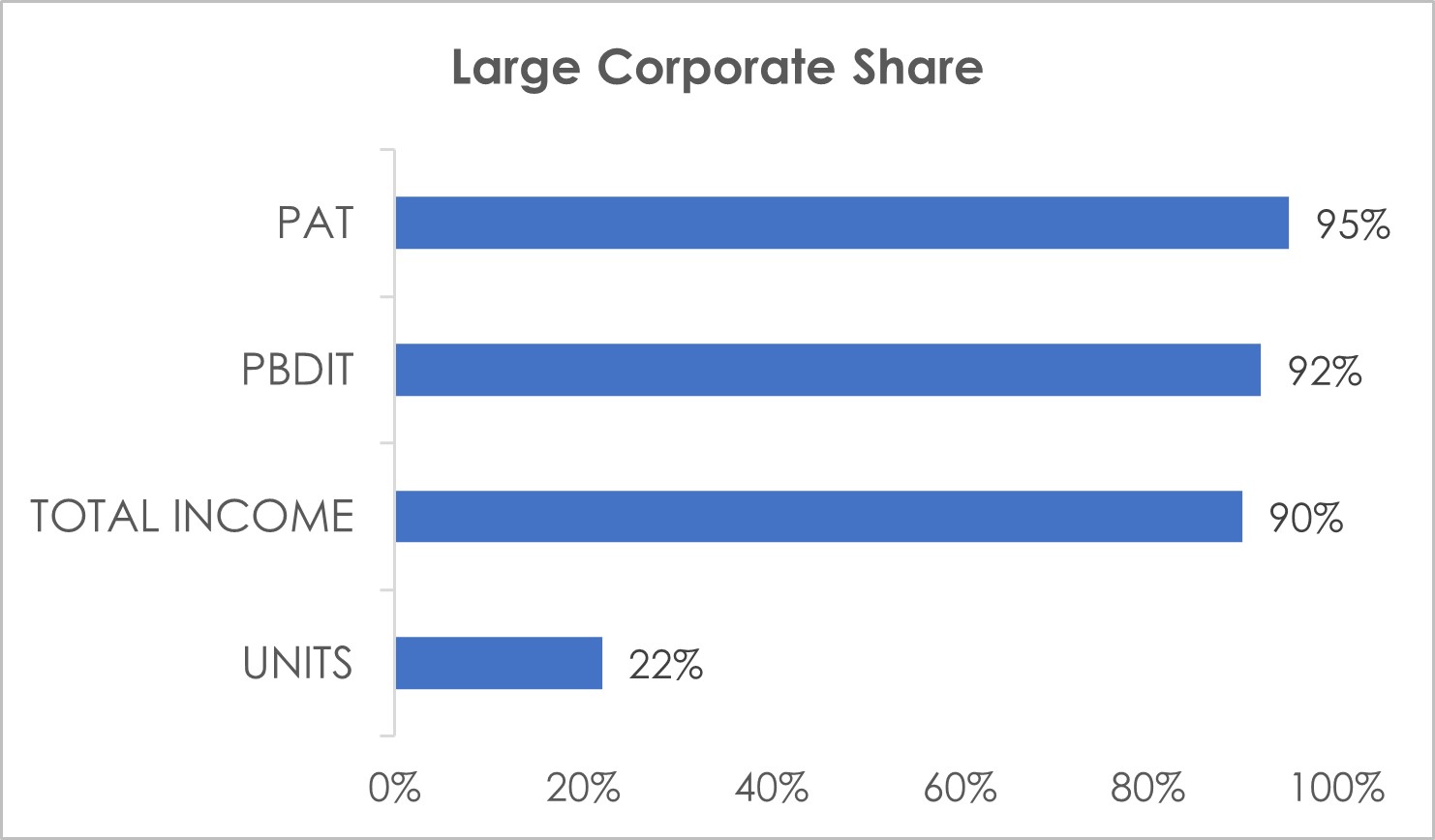

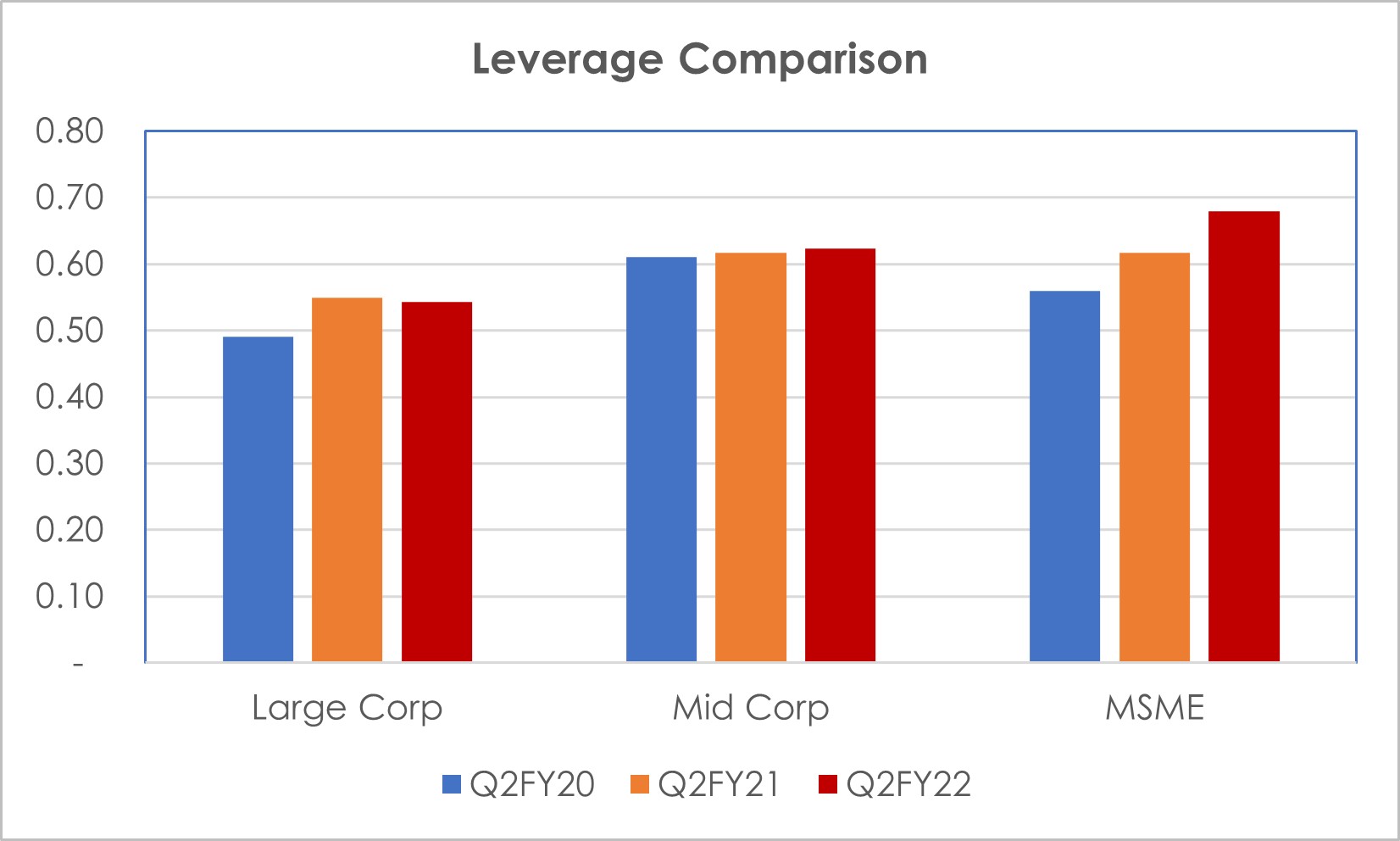

- The study reveals that the large corporate sector has been a significant beneficiary of the weaker commodity prices and the cost rationalization initiatives taken in the early part of the pandemic. While they comprise 22% of the sample portfolio, they have accounted for 90% of the aggregate PBDIT and 95% of the gross PAT quantum. 67% of the large corporates in the sample had a conservative leverage level of less than 0.5 times and they have also benefitted from the sharper drop in the interest rates on their borrowings.

- However, the recovery is only partial in the MSME sector in terms of revenues. The gross income in the MSME pool in the second quarter of the current fiscal is still 11.5% lower compared to that in Q2FY20. Further, the pandemic has aggravated the profitability pressures that the MSME sector was already witnessing in FY20; while the average PBDIT margins in this group was in the band of 8.5%-10.0%, it has continued to record aggregate losses over the last two years albeit the quantum has reduced materially by 46% in Q2FY22 YoY.

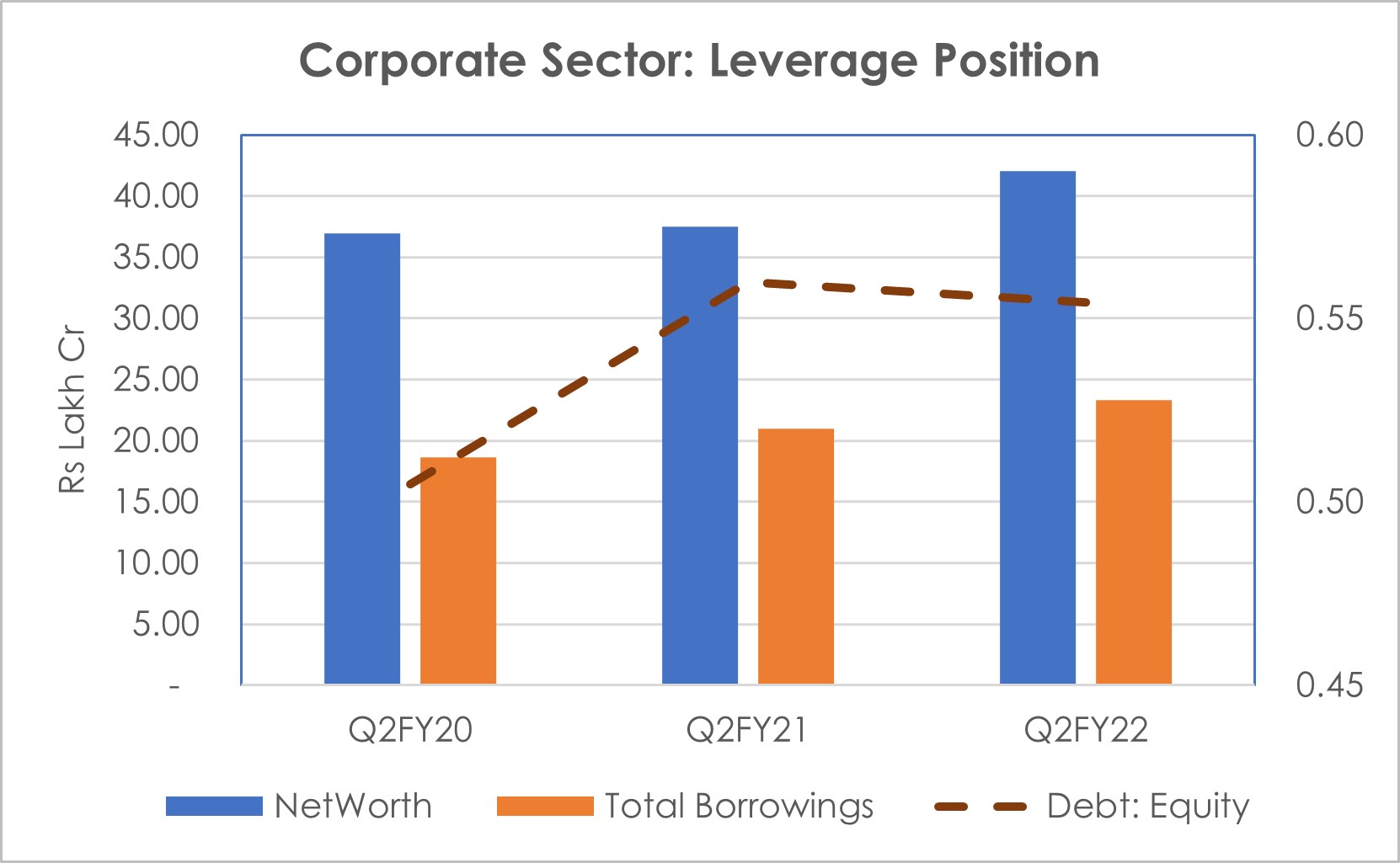

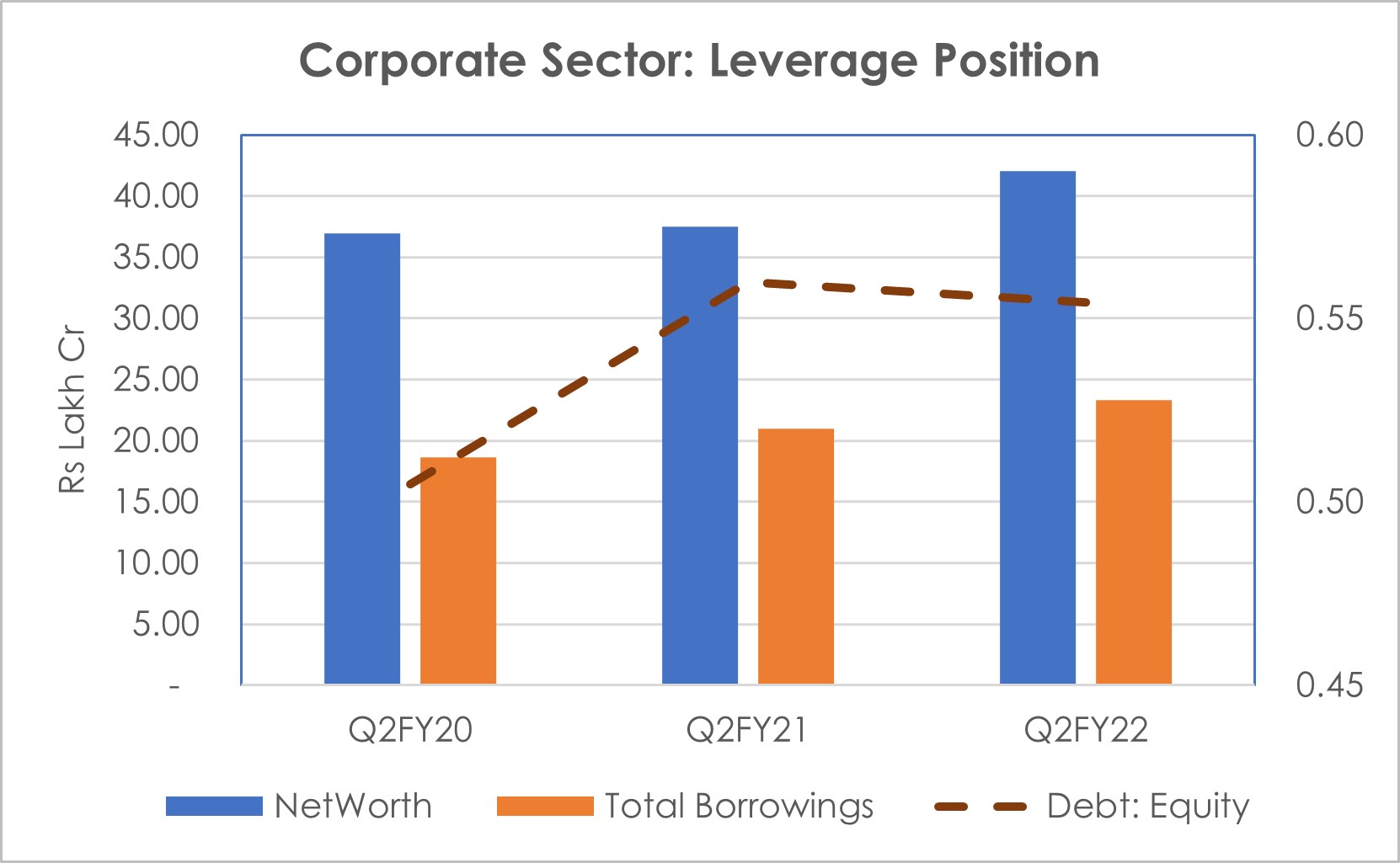

- The debt levels of the corporate portfolio have increased at an annual average of 11.9% over the last two years primarily due to a pickup in working capital borrowings including the facilities availed under Emergency Credit Line Guarantee Scheme (ECLGS). We believe that the reported growth in borrowings will start to drive a moderate level of credit growth in the current year.

|

Introduction

Acuité Ratings has undertaken a study on the financial performance of 1849 listed corporates that have published their second quarter (Q2FY22) results by end of Nov’21. The objective of the study was to understand the impact of the Covid pandemic on the business position i.e. both revenues and margins as well as the trajectory of the leverage in the balance sheet. The study covers a diverse set of companies across the manufacturing, services and the trading sector spanning large, mid and MSME businesses. For the purposes of this report, we have defined large corporates as those with quarterly revenues beyond Rs 500 Cr, mid-sized between Rs 50 – 500 Cr and MSMEs as those with total income less than Rs 50 Cr per quarter. In our study sample, 31% are MSMEs while 47% are from the mid-corporate sector and the balance 22% represent the large corporate sector.

Overall Conclusions

An overall analysis of the aggregate corporate portfolio highlights the following:

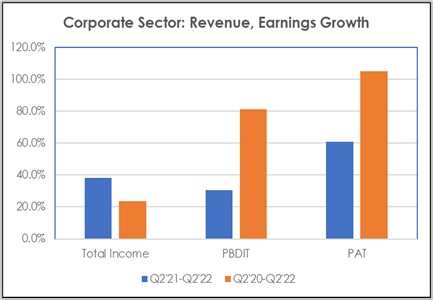

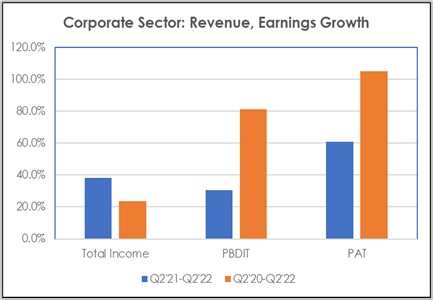

- The aggregate revenues of the portfolio in Q2FY22 have grown sharply by 38.0% on an annualised basis but even compared to the pre-pandemic quarter of Q2FY20, the reported growth stands at 23.6%. This reflects a healthy recovery in corporate performance in the current fiscal on the back of the unlocking of the economy and a revival in consumption demand.

- Importantly, the profitability has witnessed a sharper improvement with PBDIT growing by 81% compared to Q2FY20 and the net profits have more than doubled (105%) over this 2 yr period.

- The average operating i.e. PBDIT margin for the corporate portfolio had jumped from 13.3% in Q2FY20 to 20.7% in Q2FY21 while slightly moderating to 19.5% in Q2FY22. The PAT margins have also moved up sharply from 5.7% in the pre-pandemic quarter to 9.5% in the last quarter. Clearly, the improvement in profitability in the overall corporate sector has been driven by the lower input and operating costs particularly over the earlier part of the pandemic period though raw material costs have started to increase perceptibly in the current year, raising doubts on the sustainability of the higher margins.

Source: CMIE Prowess, Acuité Research

As regards the debt levels of the sample portfolio, it has increased at an annual average of 11.9% over the last two years. We reckon that this is primarily due to a pickup in working capital borrowings including the facilities provided and availed under Emergency Credit Line Guarantee Scheme (ECLGS). Higher cost of commodities and raw materials have been a factor over the last one year. This, however, has not been reflected in banks’ credit growth as a part of the additional borrowings might have been raised through debt instruments. However, we believe that the reported growth in borrowings will start to drive a moderate level of credit growth in the current year.

Source: CMIE Prowess, Acuité Research

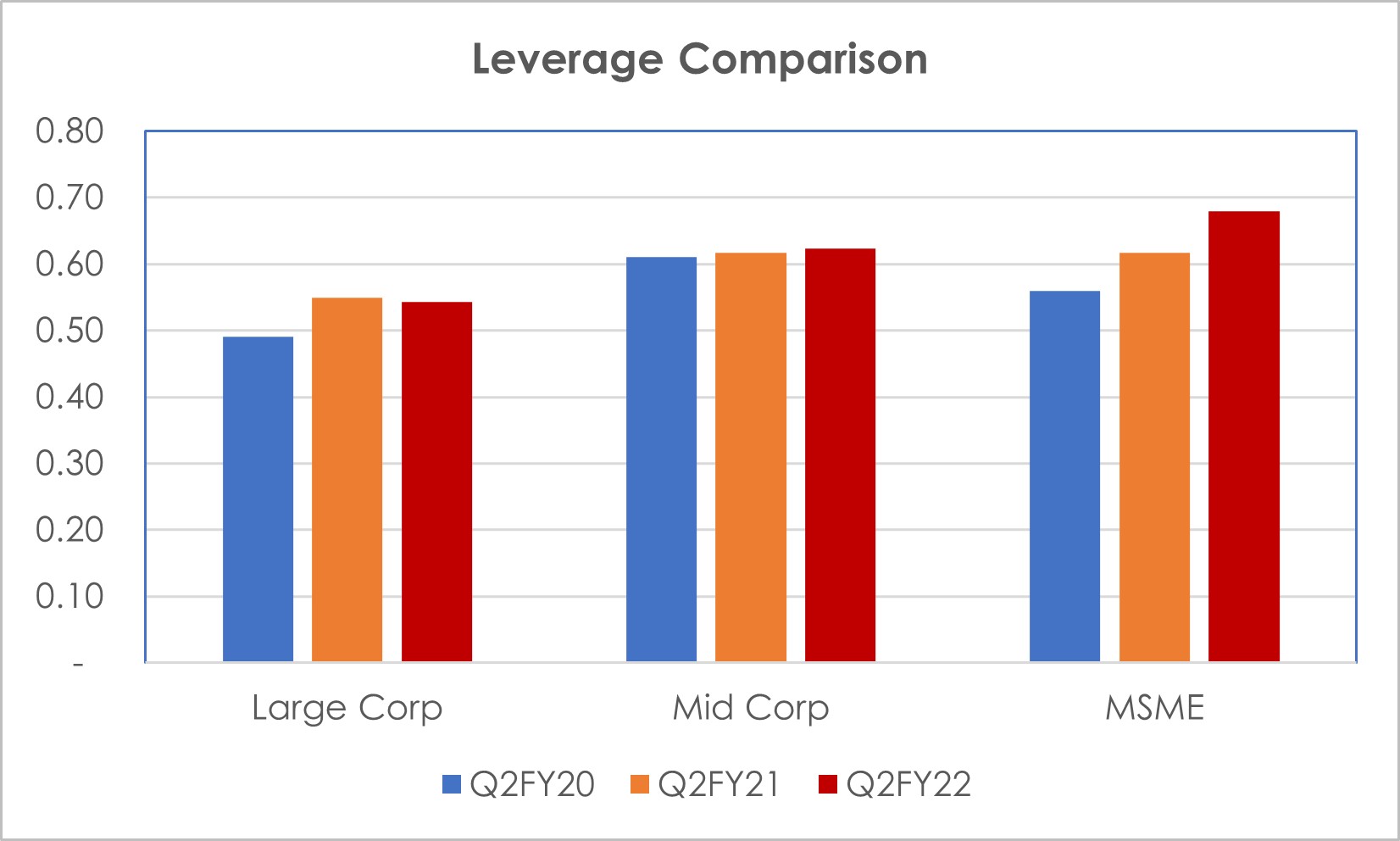

Having said that, the leverage levels haven’t really increased in the corporate sector in a material manner, going up from 0.50x as on Sep-19 to 0.55x as on Sep-21 given that internal accruals have also risen in a healthy way.

What is noteworthy is the average of the top listed companies in India is relatively low and at a collective level, they have the flexibility to raise debt for the upcoming private sector capex cycle. The study reveals that 63% of the companies in the sample portfolio (excluding a few where the networth data was not available) had a conservative leverage of less than 0.5x as on Sep-21.

Large Corporate Sector

As the next step in this study, Acuité has split the sample portfolio into Large, Medium and MSME groups as mentioned earlier, depending upon their quarterly revenues. In our sample, there were 411 companies that had quarterly total income of Rs 500 Cr or above and therefore, they have been categorised as "Large Corporate Sector”.

It is interesting to note that while large corporates comprise only 22% of the sample population, it accounts for a dominant part of not only revenues but also operating profits and net profits. While this has been the broad pattern even before the pandemic, we note that the share of large corporates in aggregate profits has slightly increased during the pandemic period. The economies of scale apart, large corporates also benefit from a superior leverage position and finer interest rates.

Source: CMIE Prowess, Acuité Research

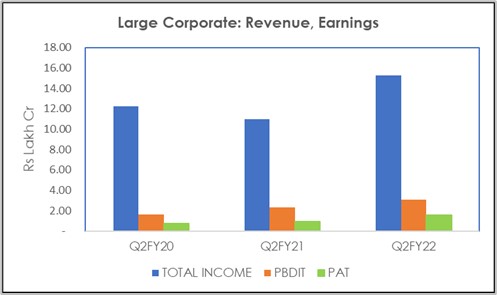

The large corporate pool largely mirrors the overall performance of the sample population:

- The revenues did drop by 10.1% in Q2FY21 due to the impact of the pandemic but has come back strongly in Q2FY22, growing by 39.1%.

- The profitability trends have been similar as in the overall sample except that the extent of growth in PBDIT and PAT in the pandemic year i.e. previous year has been stronger.

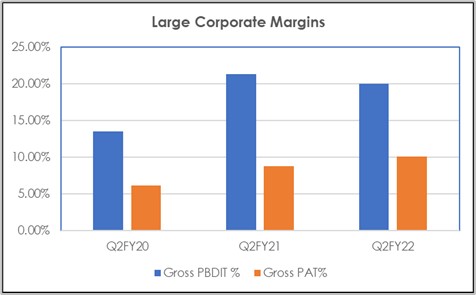

- The average operating i.e. PBDIT margin for the large corporate portfolio had jumped from 13.5% in Q2FY20 to 21.3% in Q2FY21 while slightly moderating to 20.0% in Q2FY22. The PAT margins have also moved up sharply from 6.1% in the pre-pandemic quarter to 10.1% in the last quarter. What has particularly contributed to the expansion of the net margins for this segment is the lower interest cost both due to better working capital management as well as some reduction in interest costs.

Mid Corporate Sector

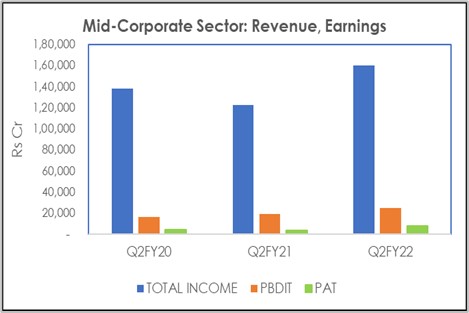

In our sample, there were 875 companies that had quarterly total income between Rs 50 and Rs 500 Cr and therefore, they have been categorised as "Mid Corporate Sector”. This comprises the bulk of the sample population in volume terms (47%).

Source: CMIE Prowess, Acuité Research

- The aggregate revenues of the mid segment in Q2FY22 have grown significantly but to a lesser extent as compared to the large corporate sector at 30.4% on an annualised basis and at 15.7% on a two year basis. The revenue recovery has been particularly high at 30.4% over the last one year.

- The profitability growth has been strong but again lower vis-à-vis larger companies at 55% compared to Q2FY20 but the net profits have risen at a faster pace at 74% over this 2 yr period.

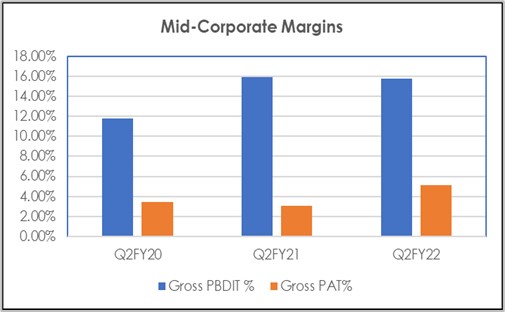

- The average operating i.e. PBDIT margin for mid corporate segment has risen from 11.8% in Q2FY20 to 15.9% in Q2FY21 and has been broadly stable at that level in Q2FY22. While the PAT margins were slightly lower in Q2FY20, it has seen a perceptible improvement in Q2FY22. This highlights the fact that the unlocking of the economy has had a more positive impact on this category in terms of net margins.

MSME Sector

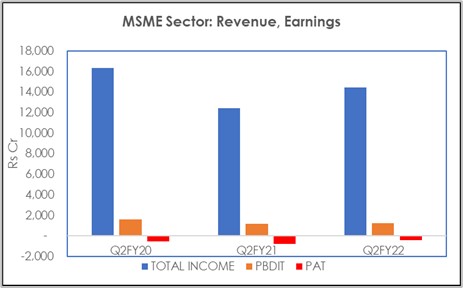

The sample consisted of 563 companies that had quarterly total income less than Rs 50 Cr and they have been designated as part of the "Small and Medium Enterprises Sector”. This comprises a sizeable 31% of sample population in volume terms.

Source: CMIE Prowess, Acuité Research

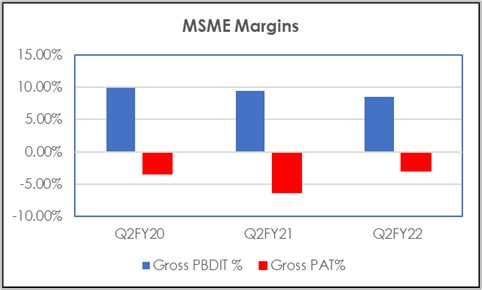

It is pertinent to note that the revenue and the profitability trajectory for the MSME sector has been significantly different as compared to large and mid-corporates.

- The gross revenues in the MSME sector did witness a moderate recovery in Q2FY22 and grew by 16.7% from a lower level induced by the pandemic; Q2FY21 revenues had sharply slipped by 24.2% from the pre pandemic year. However, it is still to catch up with the latter levels with a gap of 11.5% persisting with the latest quarter. We reckon that this is partly due to the fact that there is a larger proportion of services sector companies in this segment that have been more adversely impacted by the pandemic.

- The stress in the segment is reflected by the substantial 27.7% drop in the PBDIT levels last year itself (Q2FY21) and while there was a modest recovery of 4.7% in the current year, it lags behind the pre Covid levels in a substantial manner. What is further relevant to highlight is that the aggregate PAT of the group has remained negative throughout these three years although the quantum of losses has reduced by 46% since last year.

- The average operating i.e. PBDIT margin for the MSME portfolio has been in a narrow range between 8.5%-10.0% over the last 2 years. However, it is clear that these margins were not adequate to cover the other fixed costs including interest, leading to negative net margins. It needs to be pointed out that the profitability in this segment was under strain even in the pre-pandemic year which had seen a weak GDP growth of 4.5%.

- The average leverage in the MSME segment at 0.68x are moderately higher vis-à-vis the overall average levels at 0.55x as on Sep-21. The gross borrowings have increased by 8.2% over the last one year, leading to a slight increase in leverage.

Source: CMIE Prowess, Acuité Research

A comparison of the leverage position across the corporate segments indicates that the pandemic has not led to any sharp increase in borrowings or leverage in any. For both large and mid-corporate on a collective basis, the leverage levels have been very stable in the last two years. There has been, however, a moderate increase in leverage in the MSME sector due to weak earnings and some increase in working capital borrowings including the ECLGS facilities that were available at fine rates.