22 Aug 2019

India’s coal imports by power plants have jumped by ~41% YoY to 18.4 million tonnes (mt) during Q1 FY20. The development dampens the country’s efforts in cutting down reliance on imports. Further, the rise has been widespread as, in addition to the more traditional importers which are the private gencos (generating companies) whose plants are based on imported coal, state and central gencos too have supported growth on an on-year basis thereby signifying domestic supply lagging demand. The growth in imports was primarily owing to higher power demand coupled with softer coal prices in the international market.

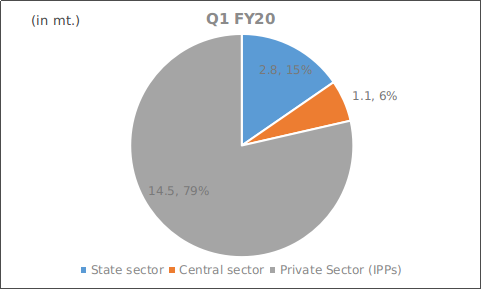

Sectoral share in imports

Note : The above quantity of coal imports is taken cumulatively for both blending and plants designed on imported coal.

Source : CEA, Acuite Research

Despite the lower quantum of imports by the state sector relative to the private sector, healthy YoY growth of ~5% was witnessed in Q1 FY20 by the former. State gencos primarily led by MSPGCL from Maharashtra, imported 1.04 mt of coal. It had in fact imported no coal during the corresponding period of last year. On the other hand, TANGEDCO from Tamil Nadu constituted 1.37 mt of overall imports (-2.4% y-o-y). From the central sector, NTPC, the country’s largest electricity generator, imported 1.1 mt after having an almost negligible amount in the previous year.

Imports by the private sector made up the majority of overall share during the first quarter of FY20. In fact, the sectoral imports leapfrogged by ~40% y-o-y primarily attributed to the sharp jump in imports by power plants located in western India's state of Gujarat viz. Adani Power and Tata Power.

Supreme Court Directive: Plant Load Factor Recoveries Positively Impacting Coal Imports

The utilities have been ramping up imports following the Supreme Court’s directive in October 2018, which cleared the way for passing on increased generation costs to consumers. The beleaguered entities’ power plants located in Mundra - had been,over the past few years struggling with lower PLFs (plant load factors) owing to under recoveries. The power plants were thereby forced to cut imports and stop/reduce power generation after the court, in its earlier order in 2016 had barred them from passing on increased prices to end consumers, after their coal supplier Indonesia had raised the price of coal.

However, post the approval of cost pass through for the higher coal prices, a multi-fold rise in imports was witnessed by both the gencos during Q1 FY20. While Adani’s Mundra unit imported 4.5 mt representing a 3 time rise, Tata Power’s unit in Mundra imported ~3 mt of coal, a 38% YoY rise. Another IPP which made up the majority of the overall imports includes JSW Energy’s Ratnagiri unit importing ~1 mt of coal.

It is noted that many of the private thermal power plants are configured to use imported coal, and thus imports by these power plants is inevitable. What remains a discord however is the rising imports by the state and central gencos. With the state sector witnessing rise in imports on account of increase in generation on account of stable rise in power demand, a lag in coal supply cannot be ruled out. Mahagenco (Maharashtra) had in fact faced coal supply crunch in later part of 2018 which had resulted it to cut down on generation. Koradi and Chandrapur power plants had primarily witnessed a significant reduction in generation during the said period despite the fact that they constitute more than half of the state sector’s installed capacity. Consequently, the state resorted to imports in order to avoid load shedding during the high demand period of 2019 during which general elections were also taking place.

Inefficient Domestic Supply Chains Fueling the Trend

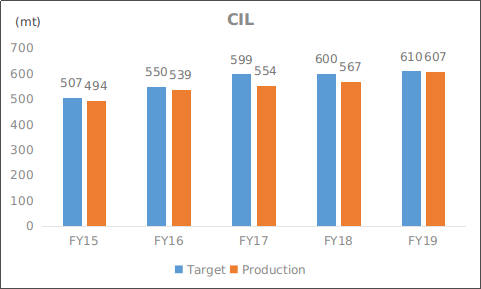

Crippling domestic fuel supply coupled with bottlenecks in transport infrastructure have been the key issues hampering the sector in the past as well. In fact, coal production growth involving CIL during Q1 FY20 was at a meagre 0.1% YoY to 137 mt, while power demand has grown at a healthy 6.7% YoY during the corresponding period. Domestic production during the period under review has therefore been flat supporting imports. Over the years, there has been a consistent effort taken by the government to increase the domestic coal production in order to reduce dependence on imported coal. Despite the prudent efforts taken by the government and an improvement witnessed in FY19 vis-à-vis previous years, production by CIL has always missed its target, as seen in the graph below.

Production vis-à-vis Target

Source : Government press releases, CIL, Acuite Research

Healthy growth in coal-fired generation has raised coal demand in the country, resulting in higher off-take from domestic sources as well as imports. Gencos which are designed to run on imported coal coupled by those plants which are located close to the coast are likely to favour imports assisting the demand going ahead. Factors such as higher cost of logistics with respect to transporting domestic coal to the plants located at a distance is likely to be supporting factor.

In order to boost the production, there has been an urgent requirement for reforms relating to prioritising efficient coal allocation and delivery, promoting competition in the sector by way of allowing commercial mining through entry of private firms. The sector which continues to face production and expansion problems involving getting the requisite forest and environmental clearances, frequent labour strikes and rehabilitation of affected people remains a key monitorable.

Further, according to the 19th EPS (Electric Power Survey) report electrical energy requirement till FY22 is expected to grow at a CAGR of 6.18% to 1,566 billion units (Bu’s). The rise in demand is likely to be supported by several policy initiatives of government such as Power for All (PFA) providing 24x7 power to all Indian households, industrial and commercial consumers, adequate supply of power to agricultural consumers, dedicated freight corridors, make in India initiative and rising inclination towards electric vehicles (EVs).

Subsequently, the coal production too needs to rise at a proportionate pace as India has pre- dominantly a coal based energy mix which is likely to continue at least in the medium term. Thus, rising imports are thereby likely to undercut the government’s efforts to reduce imports and continue until remedial action is taken at the earliest.