11 Oct 2021

Likely to hit industrial output, supply from captive mines may provide relief

As India faces an acute shortage of coal, the initial attention has been on production halt at various thermal power units and deepens the risk of power outage throughout. However, the crisis may not stop at power cuts and may lead to higher prices across various products such as steel, plastic and synthetic fibers. While coal shortages are not uncommon around the monsoon season, the impact is further exacerbated by the higher prices of coal globally and the logistical challenges. In our opinion, the supply challenges in coal is difficult to resolve immediately as production ramp-up at coal fields is a slow process and therefore the repercussions of this current shortage may extend to various industries over the near term. The recent amendment to the Captive Coal Mine rules however, may help to enhance coal supplies in the domestic market and offset a part of the shortage.

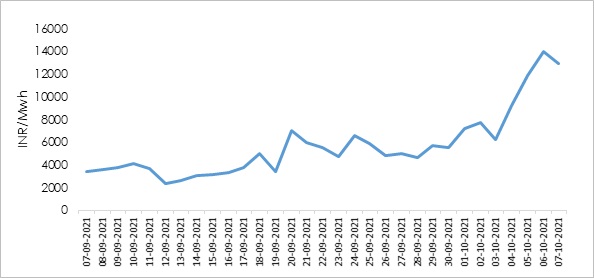

Immediate impact on power prices

The daily prices per unit on IEX have seen a sharp increase over the last month (refer to the chart below). The peak hour pricing on IEX is as high as Rs.13,949 per Mwh, while the average remains at around Rs.9328 per Mwh. Clearly, a pickup in power demand from the industrial, household and the agriculture sector due to rebound of economic post the second wave of Covid-19 has been a key factor in the spurt in merchant power prices.

Chart 1: IEX Prices: Sep-Oct'21

While the wholesale power rates on exchanges continues to remain high, the acute shortage in coal has resulted in the halt of generation or very low PLF at various power plants. The daily coal report published by National Power Portal on October 5, 2021 estimates that as high as 83.7% of the linkage-based power capacity (in Mwh) in the country has inventory of less than 4 days and about 14% power capacity actually has no coal inventory. Since this estimate assumes that the power plant is operating at a PLF of 55% and the consumption is measured as an average of 7 days actual consumption, the actual shortage of coal inventory is likely to vary for individual power units.

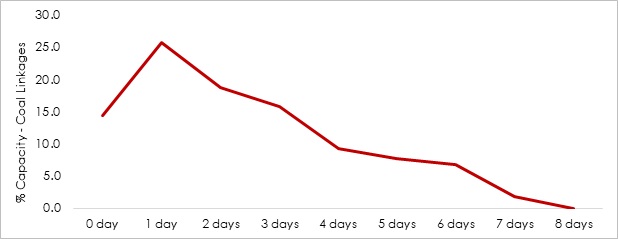

Chart 2: Days of inventory at linkage based power plants

In our opinion, it will take some time to improve the inventory position since the in-transit time for Rail Coal is upwards of 15 days. Therefore, the state utilities may have to procure power from other sources in the near term to maintain stability in the power supply levels.

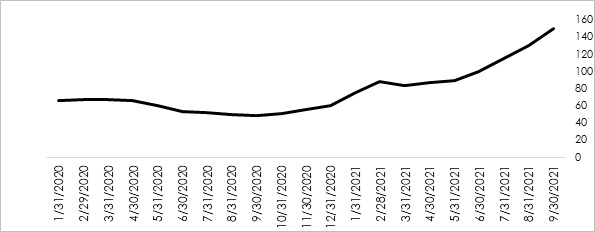

Chart 3: Indonesia Coal Prices: US $ per Ton

The other sources that the distribution companies can tap may include gas-based power generation units and power plants using imported coal but the international prices of LNG and coal are on a rise rendering the import of LNG and coal for power production unviable. The current JKM LNG prices as on October 6, 2021 stands at $56 per MMBTU propelled by supply chain constraints and production concerns at Russia Nord 2 stream as well as higher spot demands from China. Imported Coal prices at $150 per MT are already unviable leaving limited scope for imported coal-based power units to bridge the gap of current power shortage.

Will large scale power cuts become a reality?

We expect a moderate shortage of power supply in the near term with increasing household demand in the upcoming festive season as the dependence on thermal coal based power plants remain high in India and the coal inventory position is unlikely to improve within a few days. However, a recent amendment in captive coal mining rules by the Government of India may help to improve coal supply over the next few weeks. The permission given to captive coal mines to sell upto 50% of their coal output in the open market after catering to internal demand, should help to release additional supplies of coal in the market.

Nevertheless, we foresee an impact of the shortage of coal beyond the power sector. Any shortfall in coal supply to industries such as cement and aluminium may have an implication on their output levels apart from increasing the raw material costs. Any lack of power availability or higher merchant power tariffs will particularly hit the medium and small scale industries who had plans to ramp up their production in sync with the recovery in domestic and export demand.