KEY TAKEAWAYS

- IIP growth rose a tad in Aug-21 to 11.9%YoY from 11.5% in Jul-21, largely in line with market expectations.

- The expansion was primarily the outcome of a favorable base, as sequentially the index contracted by 0.2%MoM after posting strong momentum over Jun-Jul-21 subsequent to the second wave disruption.

- On sectoral basis, mining and manufacturing sectors contracted sequentially, with electricity being the lone sector in expansion.

- On use-based side, in similar vein, annualized growth driven by a positive base masked the weak sequential performance across sub-sectors.

- With Aug-21 IIP index being around 4.0% above Aug-19 levels, it reflects an expansion of industrial output vis-à-vis the pre-pandemic levels, underscoring the fact that economic recovery has progressed well.

- However, annualized IIP growth here on, is likely to drift lower into single digits as the favorable statistical base fades.

- To correctly interpret growth scenario, it will be critical to look at sequential momentum, which we expect to find support in festive season demand, progress on vaccination, rural recovery among other factors.

- On balance, we continue to retain our FY22 growth forecast at 10.0% with possible downside risks from the recent energy crisis, global supply chain disruptions and elevated commodity prices remaining on watch.

India’s IIP growth rose a tad in Aug-21 to 11.9%YoY from 11.5% in Jul-21, largely in line with market expectations. The expansion was largely the outcome of a favorable base, as sequentially the index contracted by 0.2%MoM after posting strong expansion over Jun-Jul-21.

Key Takeaways

- On sectoral basis, mining and manufacturing sectors contracted sequentially, with electricity being the lone sector in expansion (see table1)

- For the mining sector, Aug-21 marked the third consecutive month over month contraction but that is typical of monsoon related drop in activity.

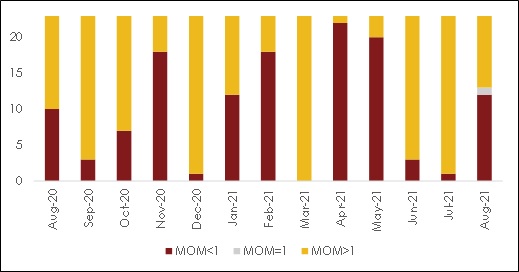

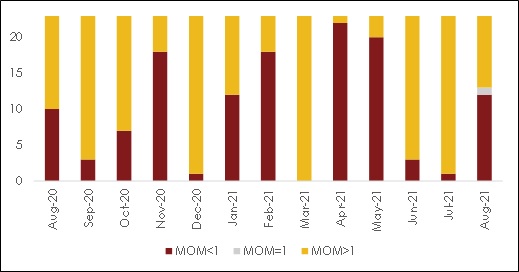

- The breadth of recovery for the manufacturing sector narrowed, with just 12 of the 23 sub-sectors recording a sequential expansion in output in Aug-21 compared to 22 a month back.

- The sub-sectors of Electrical equipment, Wood & wood products, Tobacco products saw a strong sequential expansion, while a dip in production of Motor Vehicles & Trailers, Leather products, Coke and Refined Petroleum Products along with Beverages weighed on the manufacturing index.

- On the use-based basis, in similar vein, annualized growth driven by a positive base masked the weak sequential performance across sub-sectors.

- IIP growth for May-21 was revised downwards by 100 bps to 27.6% YoY.

Comparison with Aug-19

- With Aug-21 IIP index being around 4.0% above Aug-19 levels, this reflects an expansion of IIP output on a 2-year basis, underscoring the fact that industrial activity has reached pre-pandemic levels.

- However, there remains a significant divergence at the granular level. On the sectoral side, compared to 2 years ago, while growth in electricity and mining both has been strong (13-14%) that of manufacturing (which accounts of 77% of the index) has been a tepid 1.4%

- On use-based side, all sectors with the exception of consumer durables have attained pre-pandemic levels; the latter continues to remain nearly 3.0% below.

Outlook

In our opinion, the annualized IIP growth here on, is likely to drift lower into single digits as the favorable statistical base fades. Additionally, a potential power shortage triggered by the recent energy crisis amidst lower coal supplies can have a near term impact on industrial activity. Lack of adequate coal and power availability may impact manufacturing sectors which had plans to ramp up their production amidst recovery in domestic and export demand. While the impact of the global semiconductor chip shortage is already being felt by the domestic automotive sector, other industries such as consumer durables and electronics are also likely to face production constraints ahead of the festive season amidst chip shortage.

While we expect low sequential growth in IIP over the next few months given the raw material shortages and higher commodity prices in certain sectors, we maintain our FY22 annual GDP forecast at 10.0% led by:

- Festive season facilitating pent-up demand.

- Progress on vaccination: At present, India has inoculated almost 50% of its population with single dose and fully vaccinated around 20%. As coverage nears three fourth of the population by year-end, it should provide a strong boost to consumer sentiment and demand recovery.

- Recovery in rural demand: Led by the south-west monsoon outturn being normal and Kharif acreage sown almost at par with last year’s level.

- Government spending: With capital expenditure, which has a much strong growth multiplier, taking precedence over revenue expenditure on a FYTD basis

- Export growth remaining sturdy amidst a strong V-shaped global growth recovery

Annexure-1

Chart 1: Breadth of manufacturing recovery deteriorates in Aug-21

Table 1: Anatomy of IIP growth