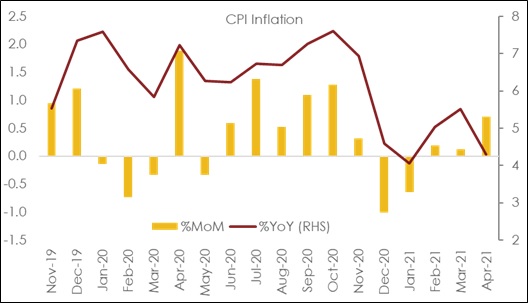

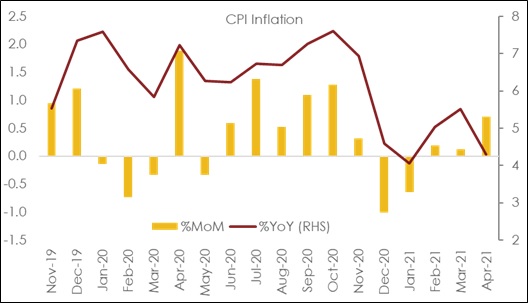

KEY TAKEAWAYS - CPI Inflation eased at the start of FY22, softening to a 3-month low of 4.29%YoY compared to 5.52% in Mar-21.

- The downside was driven by a favorable base, even as sequentially prices rose at the fastest clip in last 6 months.

- Food prices rose by a robust 0.89%MoM after a hiatus of 4 months, as the rise in mercury, higher global pass through of oil prices and lockdown induced mild disruptions started to weigh in.

- Incremental momentum in core inflation also hastened amidst broad-based price pressures.

- On inflation outlook, we retain our FY22 projection of 5.0% as we expect comfort on food inflation to sustain amidst expectations of a normal monsoon in 2021 and robust Rabi output. However, we do acknowledge upside risks from – 1) Rising crude oil price 2) Uncertainty with respect to ongoing wave of COVID, and 3) Higher input costs, with several global commodity prices rallying to record highs.

- CPI inflation is however, unlikely to trigger any rate action from RBI given its commitment and need to preserve the nascent growth momentum currently threatened by the second wave of the pandemic.

|

CPI Inflation eased at the start of FY22, softening to 4.29%YoY compared to 5.52% in Mar-21. The downside was driven by a favorable base, even as sequentially prices rose at the fastest clip in last 6 months. Recall, last year’s elevated April inflation (at 7.22%) was released as an imputed value with a lag, as the nationwide lockdown disrupted real time data collection.

Granularity of Apr-21 inflation

- On an annualized basis, headline inflation at a 3-month low was dragged down by most sub-categories with the exception of Housing and Fuel and Light, amidst a positive base at play. This masked the broad-based sequential increase in the overall index by 0.7%MoM.

- Food prices rose by a robust 0.89%MoM after a hiatus of 4 months, as the rise in mercury (with an early onset of summer), higher global pass through of oil prices and lockdown induced mild disruptions started to make an impact. Within food, once again 3 categories saw heightened price pressures – Meat & fish (+3.02%), Oils & fats (+3.78%) and Fruits (7.09%), as compared to Mar-21. Providing some respite, prices of vegetables – the lone food category in decline, eased for the fifth consecutive month.

- Surprisingly, fuel prices remained unchanged from previous month, owing to a fall in LPG prices in Apr-21.

- Incremental momentum in core inflation (i.e., CPI ex Food & Beverages and Fuel & Light indices) rose to 0.57% compared to 0.21% in the previous month, amidst broad-based price pressures seen in Housing (+0.94%), Clothing & footwear (+0.58%), Miscellaneous (+0.46%) and Pan, Tobacco, Intoxicants (+0.37%). Personal care & effects, within miscellaneous category, rose by 1.04%MoM as gold prices shot up in the month.

Urban inflation takes a breather

Rural inflation in line with headline, eased to a 3-month YoY low of 3.82% vs. 4.61% in Mar-21. On the other hand, urban inflation registered a sharper moderation to a 20-month low of 4.77% (vs. 6.52% in Mar-21) amidst a more favorable base vis-à-vis rural CPI index. This is because amidst the lockdown in Apr-20, urban supply and supply chains had taken a much severe hit to push up the urban inflation index. As such, despite remaining elevated, the gap between urban and rural inflation eased to 95 bps from vs 186 bps in Q4 FY21.

Outlook

Apr-21 CPI inflation marks a good start to FY22 with inflation moving close to mid-point of RBI’s inflation target band of 2-6%. This comfort is however, illusory and will prove to be ephemeral as it is driven primarily by base effect.

On inflation outlook, we retain our FY22 projection of 5.0% as we expect comfort on food inflation to sustain amidst expectations of a normal monsoon in 2021 and robust rabi output.

However, upside risks remain from –

- Fuel inflation, already ruling at a 2-1/2 year high, could get intensified amidst the recent hardening of global crude oil prices (by 6.0% in May-21, so far). Retail price of petrol and diesel have resumed daily upward adjustments post the state elections, which will add to inflationary pressures, unless countered by fuel tax reductions by the center and state Governments.

- Uncertainty with respect to second wave of Covid continues to linger. Daily confirmed cases, while have eased from 4 lakh cases to 3.5 lakh cases over the last few days, nevertheless continue to remain elevated. In a bid to control the infections, larger number of states have announced stricter lockdowns since beginning of May-21. While Apr-21 did not point to any strong supply side disruptions, May-21 data will be more discerning from this perspective. Further, with consumer demand expected to take a hit, the interplay of supply and demand side dynamics on inflation in this wave of Covid remains to be seen.

- Pass through of higher global commodity prices other than crude, many of which such as copper and steel are near record highs, could add to input costs, already visible in a record-high WPI inflation in March 2021.

- Having said so, CPI inflation is unlikely to trigger any action from the RBI given its commitment and need to support growth at this juncture. As our base case, we continue to expect the central bank to keep repo rate unchanged at 4.00% until the end of FY22.

Annexure

Table1: Key highlights of Apr-21 CPI inflation data

Chart 1: International prices have a dominant influence on India’s trade